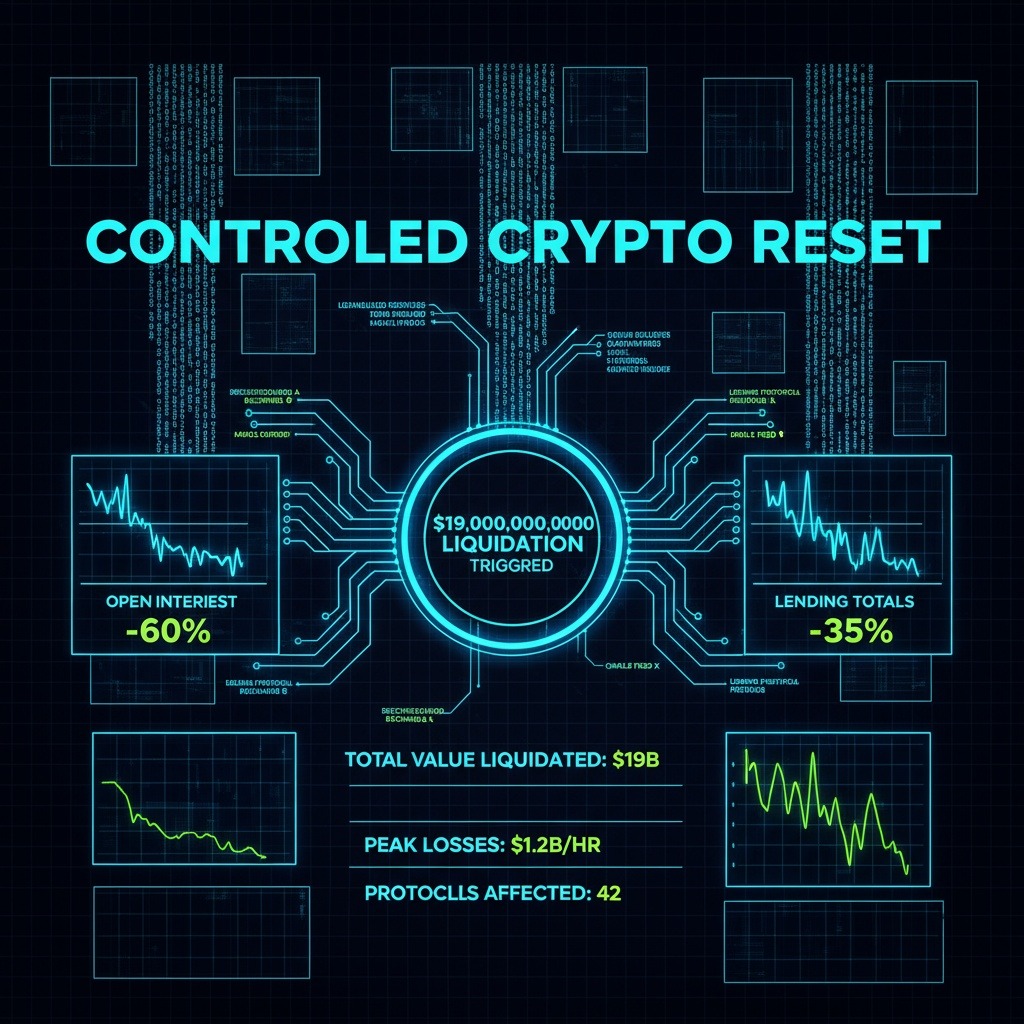

$19 Billion Crypto Liquidation Largely Reflects Controlled Deleveraging, Analysts Say

Friday witnessed an unprecedented $19 billion liquidation event across the cryptocurrency market, stirring debate among traders and analysts about the nature of the sharp downturn. While some market participants suggested a coordinated effort by major players to trigger a sell-off, blockchain data points to a primarily organic resetting of leverage. During the flash crash, open interest in perpetual futures on decentralized exchanges (DEXs) plunged dramatically—from $26 billion down to under $14 billion—according to data from DefiLlama. Concurrently, trading fees on crypto lending protocols soared past $20 million in a single day, marking a new high, while weekly volumes on DEX