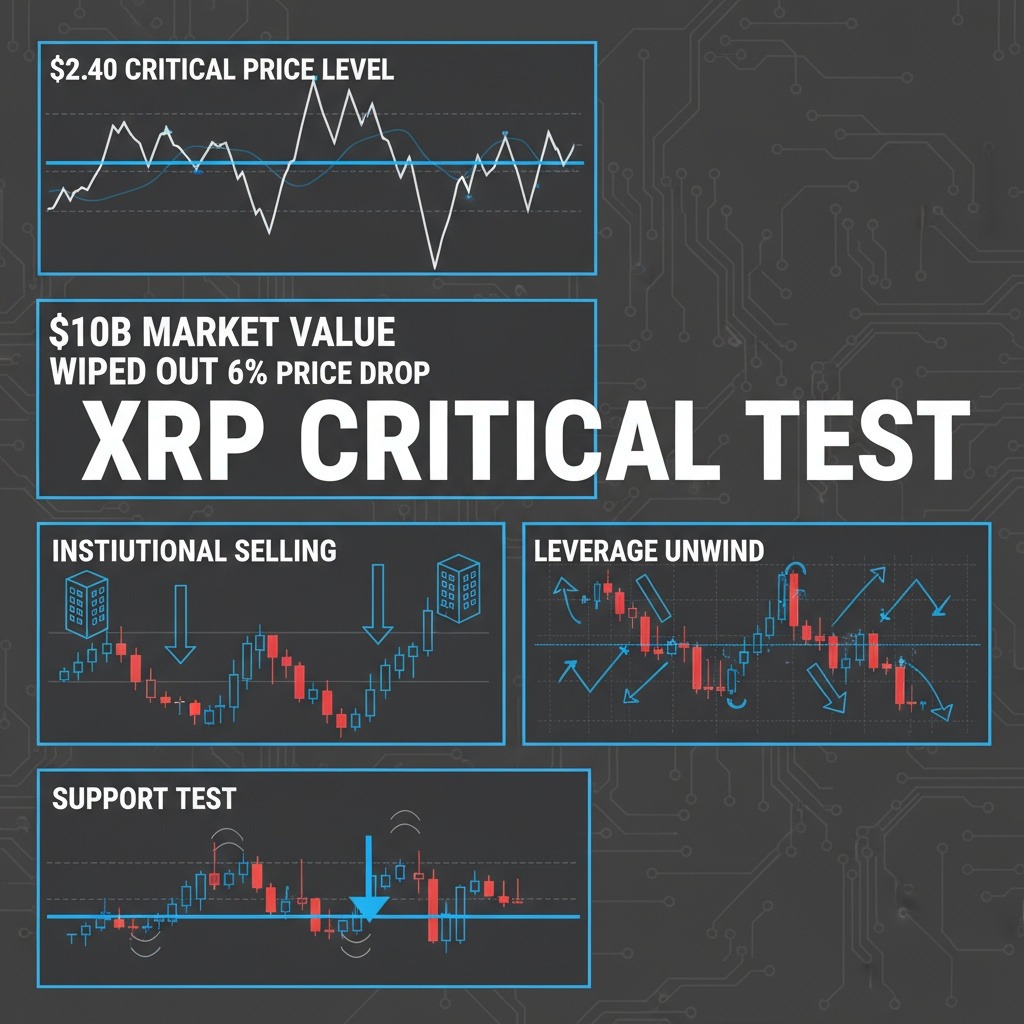

XRP experienced a significant sell-off this week, driven primarily by large-scale institutional liquidation across derivatives markets, which erased roughly $10 billion in market value. Between October 14 and 15, the price of XRP dropped sharply from $2.49 to $2.41, marking one of this month’s most pronounced single-day declines for the digital asset.

The recent price drop follows a period of sustained selling pressure by major holders, often referred to as whales. Since October 10, approximately 2.23 billion XRP tokens, valued at around $5.5 billion, were transferred onto exchanges. This surge in supply contributed to heavy downside pressure.

The futures market reflected this shift as well, with open interest on XRP contracts halving to $4.22 billion. This rapid contraction signals forced deleveraging, as market makers and leveraged traders reduced exposure amid persistent macroeconomic uncertainties and ongoing regulatory developments.

During a volatile 24-hour stretch ending at 20:00 UTC on October 15, XRP’s price plunged from $2.56 to $2.41, representing a 6% loss and intraday volatility of over 6%. Intense selling escalated between 13:00 and 15:00 UTC, with trading volumes climbing from 119 million to 154 million tokens. Efforts to hold support around $2.48–$2.50 failed, triggering a cascade of liquidations that pushed XRP to a low near $2.40.

A subsequent rebound attempt saw the price briefly recover to $2.44 at 19:27 UTC but was quickly rejected, leading to a close just above the day’s lows. Trading volume peaked near 4.5 million tokens during the final hour, signaling a capitulation phase before activity waned.

Technically, falling below the $2.48 level indicates a short-term reversal in XRP’s trend. The nearest support zone now lies between $2.40 and $2.42, with resistance levels identified between $2.55–$2.56 and higher supply pressure near $2.65. Volume and trading patterns suggest the selling was dominated by institutional participants, rather than retail investors.

Despite momentum indicators entering oversold territory, a solid return of buyer interest on a meaningful scale has yet to emerge. Funding rates across leading derivatives exchanges have turned negative, reinforcing a bearish market sentiment as the week progresses.

Market observers are closely monitoring several key factors over the coming days:

- Whether the $2.40 support level can hold if large holders continue to offload XRP.

- Rebuilding of futures open interest following the recent 50% decline — indicating potential market stabilization or further short selling.

- Comparison of spot inflows against exchange outflows to assess if accumulation by investors is resuming.

- Price action near the $2.65 resistance area, which could confirm any credible relief rally.

The current environment points to a consolidation phase around the $2.40 mark until leverage conditions stabilize and clearer directional cues emerge from both spot and derivatives markets. Close attention to institutional behavior and technical levels will be essential for understanding XRP’s near-term trajectory amid ongoing volatility.