In a story rapidly gaining traction on social media, a woman’s success in earning a substantial income has led to an unusual family conflict, spotlighting the complex dynamics that can arise when financial roles shift within households.

The woman, whose identity has remained private, reportedly earns a very comfortable living thanks to a flourishing career. While many would celebrate the accomplishment and the opportunities it brings, the situation took a tense turn due to her mother-in-law’s reaction. The mother-in-law, it appears, is upset not because of any financial hardship but rather because she feels she is not able to freely “take full advantage” of her daughter-in-law’s prosperity.

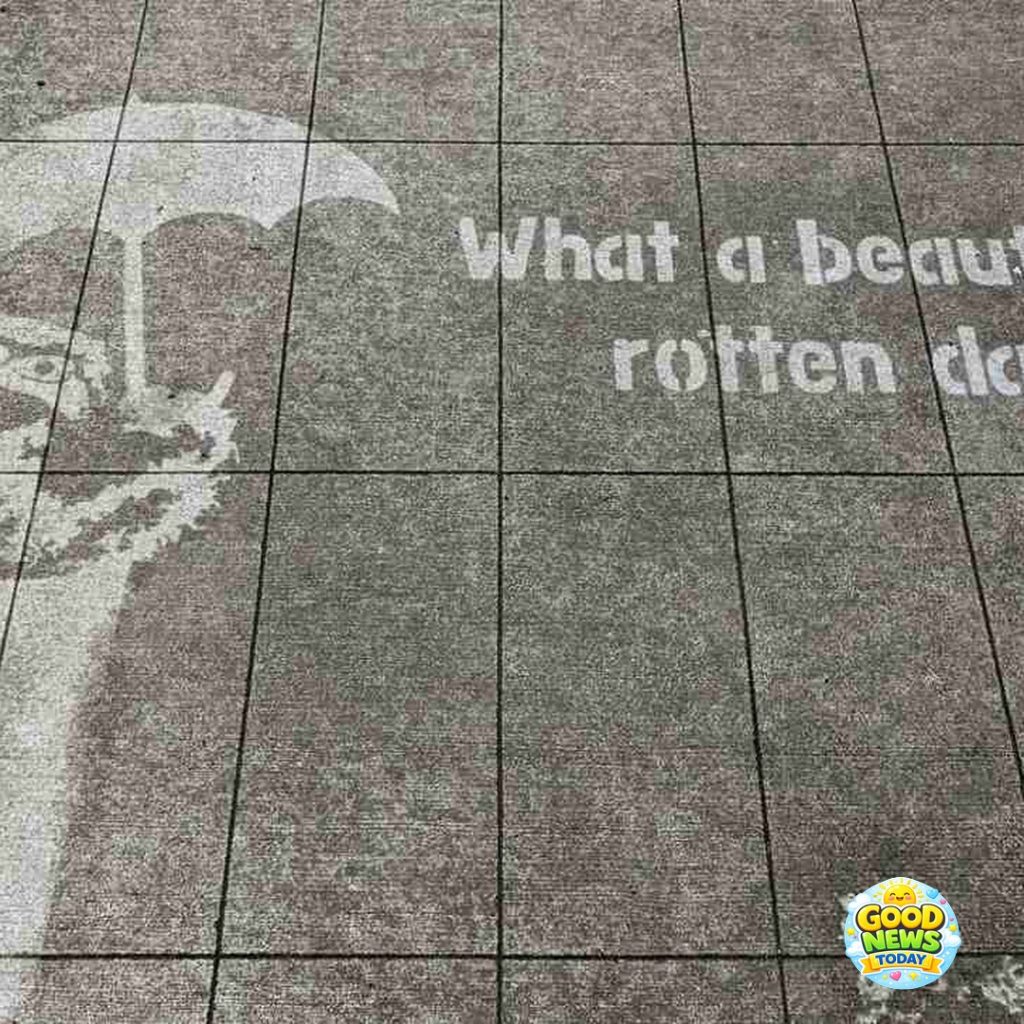

On various social media platforms, excerpts from conversations have gone viral, showing the mother-in-law’s frustration summed up by the incredulous remark: “But you are rich.” This concise phrase seems to underscore a perceived entitlement or expectation that the daughter-in-law’s earnings should directly benefit her family beyond their usual boundaries.

Adding another layer to the story, the woman shared an incident where her mother-in-law called her under pretense. The call, initially described as pretending to need help or support, was reportedly a way to subtly remind the daughter-in-law of her “rich” status and the implied pressure to share or offer financial assistance. While details remain somewhat limited, this anecdote highlights a subtle but poignant strain between affection and financial expectation.

Experts on family dynamics note that such scenarios are not uncommon when traditional expectations about income and family roles evolve. “When a woman becomes a primary earner or significantly contributes financially, it can disrupt established family hierarchies and expectations,” explains a family therapist. “If this results in feelings of exclusion or jealousy from other family members, particularly in-laws, it may lead to conflict.”

Many online commenters have empathized with the woman, applauding her for her financial independence and cautioning that success should never be a source of family discord. Others reflected on the delicate balance required to maintain respect and healthy boundaries when wealth enters family interactions.

This story underscores a modern challenge: how families reconcile changing financial landscapes without letting money become a wedge in relationships. Navigating such tension requires open communication, clear boundaries, and mutual respect—ideals that can be difficult but necessary to preserve family harmony.

While the incident is a snapshot of one family’s experience, the viral discussion it has sparked reminds us all of the evolving nature of family and finance in the 21st century. As more women take on prominent economic roles, stories like this could become increasingly common, encouraging us to rethink traditional assumptions and foster greater understanding within families.

Readers are encouraged to reflect on their own family dynamics and consider how financial success can be celebrated together rather than becoming a source of conflict.