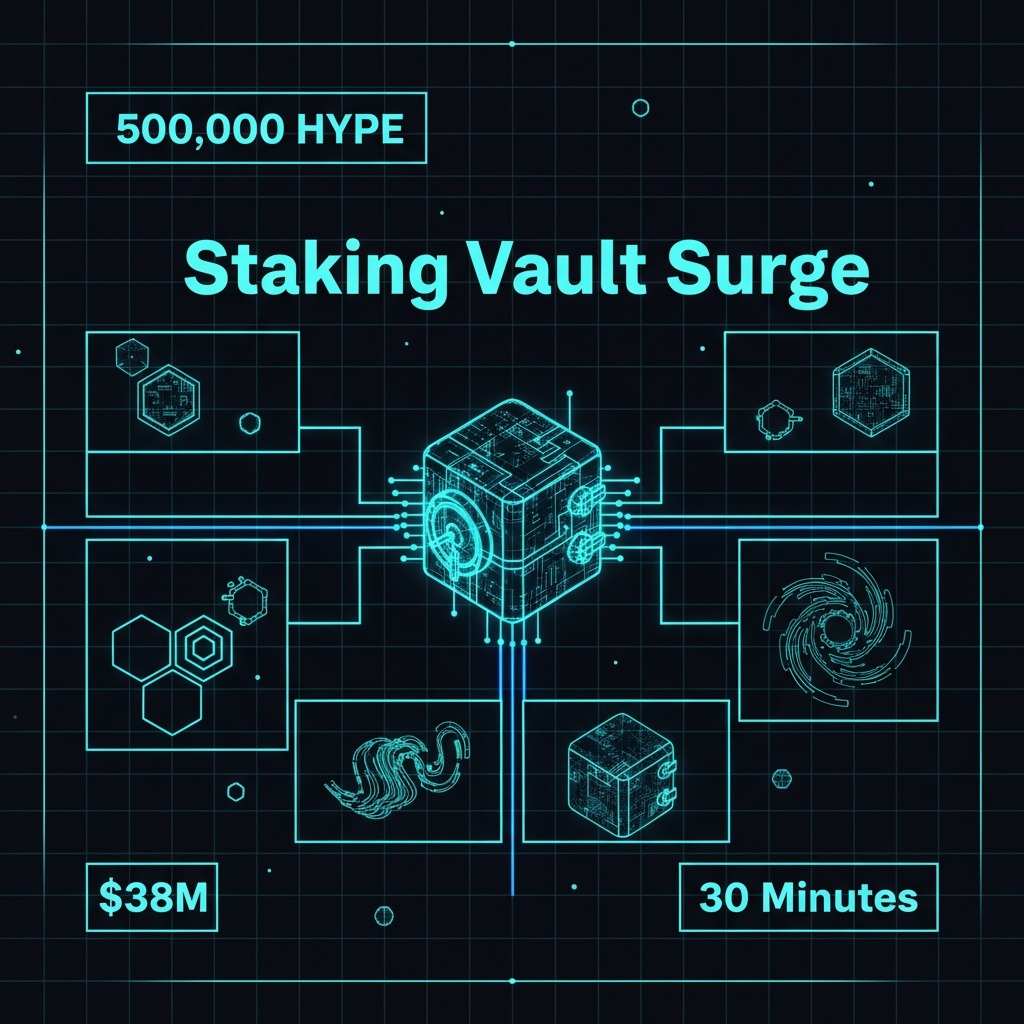

Ventuals, the emerging platform focused on trading tokenized private and pre-IPO companies, has made a strong market entry with its newly launched HYPE liquid staking vault. The vault successfully surpassed its initial deposit goal of 500,000 HYPE tokens—equivalent to nearly $19 million—within just five minutes of going live.

The milestone triggered a rewards boost for early participants, who received a 10x multiplier on their points as well as exclusive Ventuals NFTs to acknowledge their early support. Among the initial depositors, the largest contributor staked 250,000 HYPE tokens, demonstrating considerable confidence in the project’s prospects.

Following the rapid achievement of the minimum threshold, capital inflows accelerated further. Within 30 minutes, the vault accumulated over 1 million HYPE tokens, valued at around $38 million, with the total reaching approximately 1.29 million HYPE at the time of reporting.

The funds gathered through the vault will be instrumental in launching Ventuals’ permissionless derivatives market under the HIP-3 framework on the Hyperliquid platform. This market aims to facilitate trading of tokenized assets from private equity and pre-IPO firms, setting Ventuals apart from other derivatives protocols.

Ventuals positions itself in competition with established HIP-3 projects like Hyperliquid’s largest liquid staking platform, Kinetiq, and TradeXYZ, a derivatives trading venue created by Unit, which leads the ecosystem in tokenization solutions.

What makes Ventuals distinctive is its niche focus on private equity and pre-IPO company tokens, including high-profile names such as OpenAI, SpaceX, and Kraken. During the testnet phase, some of the most actively traded markets were Kraken, Neuralink, and Polymarket, signaling strong interest in these assets within the community.

As Ventuals continues to build momentum, the successful capital raise via the HYPE vault marks an important step in bringing tokenized private markets into more accessible, liquid trading environments. This development aligns with broader efforts in decentralized finance to expand asset class availability and participation.