Auto-deleveraging (ADL) acts as a critical fail-safe on cryptocurrency perpetual futures platforms, stepping in to reduce winning positions during extreme market stress. Doug Colkitt, founder of Ambient Finance, recently clarified how ADL functions and why even experienced traders may find its impact surprising.

Perpetual futures, often called “perps,” are cash-settled derivative contracts without expiration dates. They closely track the spot market through periodic funding payments rather than physical delivery of coins. Unlike traditional asset trading, both profits and losses on perps are settled against a shared margin pool, not through actual transfers of cryptocurrency. This setup requires exchanges to rapidly adjust exposure when accounts face liquidation, especially during periods of heightened volatility.

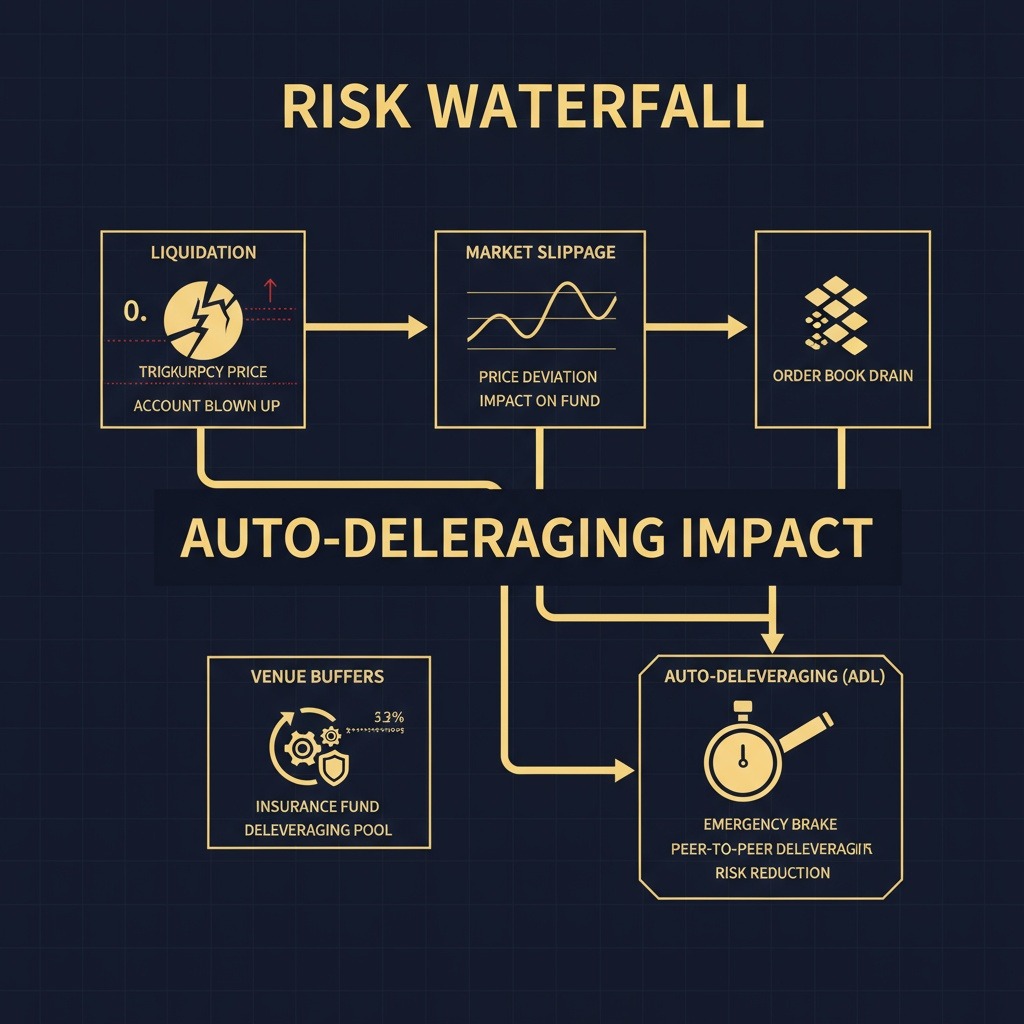

Colkitt describes ADL as the “last line of defense” within a layered risk management process. Under normal conditions, when an account’s margin falls to zero, the platform liquidates its position into the order book near the bankruptcy price. If the market cannot absorb these liquidations due to slippage, exchanges rely on buffers such as insurance funds, programmatic liquidity providers, or specially designated vaults. These buffers help soak up distressed selling and can even generate profits by buying assets at steep discounts to later sell during rebounds, as demonstrated by Hyperliquid’s vault netting approximately $40 million during a recent crash.

However, these buffers have limits. Once exhausted, and if a shortfall persists, ADL is triggered to maintain the platform’s solvency. Using an analogy, Colkitt compares this to an overbooked flight where the airline first seeks volunteers to give up their seats, but if none do, passengers are involuntarily removed. Similarly, ADL forcibly reduces portions of profitable traders’ positions—particularly those with large, highly leveraged gains—to rebalance the market and settle obligations.

The order in which accounts are deleveraged is determined by a queue that weighs factors like unrealized profits, leverage levels, and position size. This often means the largest and most profit-rich traders face reductions first. The deleveraging happens at preset prices tied to the side facing bankruptcy and continues until losses are fully absorbed, after which normal trading resumes.

This process understandably frustrates traders, as ADL can cut into winning positions at the market’s peak momentum, interrupting the regular flow of execution. Yet, Colkitt stresses its structural necessity: perpetual futures represent a zero-sum environment. Behind these contracts are only cash claims between long and short positions, not physical coins. If liquidations do not settle at or above bankruptcy prices and buffers run out, the platform must instantly rebalance exposure to avoid cascading insolvencies.

Importantly, ADL events are rare and typically only occur in times of significant market distress. Most liquidations and buffers function effectively on a daily basis, allowing traders to close profitable positions naturally. The existence of ADL enables platforms to offer perpetual contracts with high leverage and no expiry without incurring unlimited losses on one side.

Colkitt also points out that ADL exposes the underlying architecture of perpetual futures markets. While these instruments simulate spot trading convincingly, extreme market conditions push platforms to reveal their internal risk management mechanisms. This includes transparent queues, clear trigger parameters, and increasingly, visual indicators on trading interfaces informing users about potential ADL risks.

In summary, auto-deleveraging is a vital but lesser-known function within crypto perp markets that safeguards platform stability by reducing profitable positions when necessary. Understanding ADL can help traders better navigate the risks inherent in high-leverage perpetual futures trading.