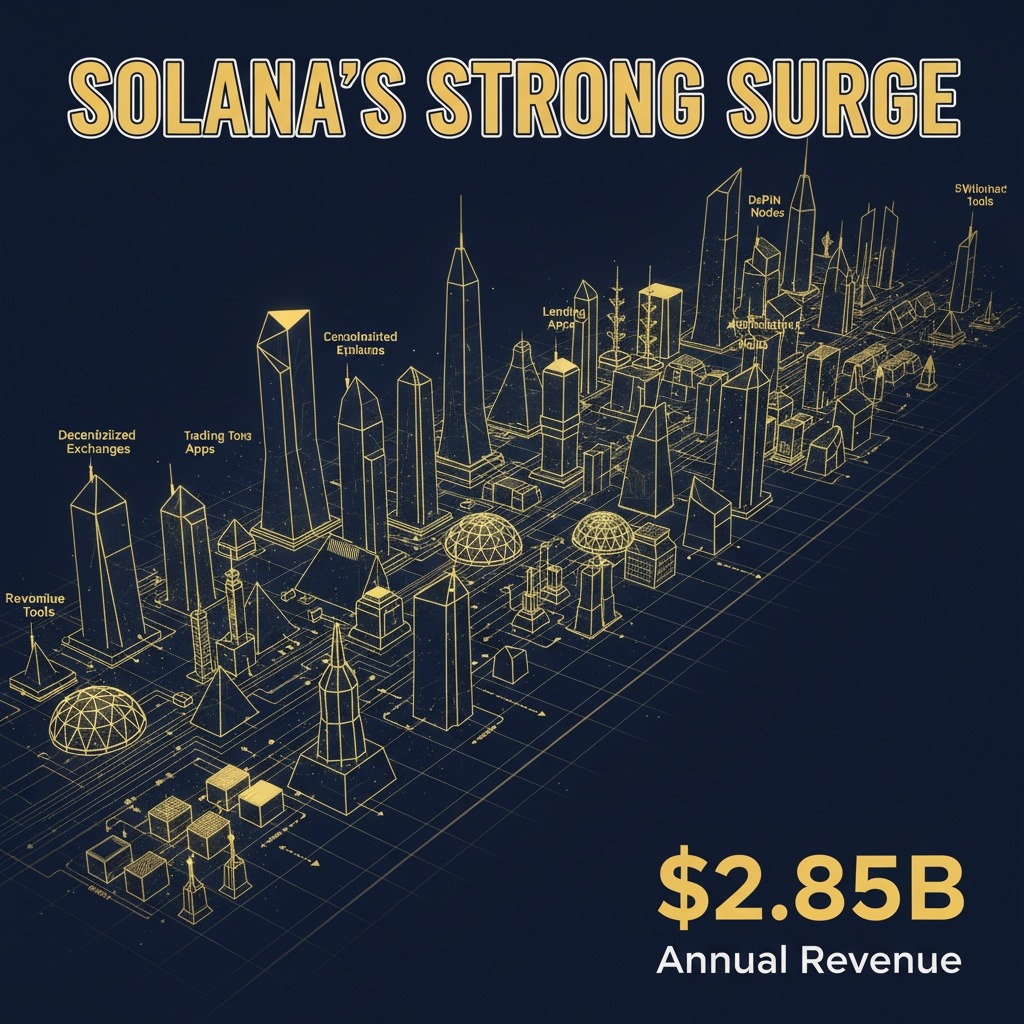

Solana’s blockchain network is demonstrating remarkable resilience and growth, as recent research reveals it generated approximately $2.85 billion in annual revenue from October 2024 through September 2025. This impressive figure positions Solana alongside established technology companies like Palantir and Robinhood, marking its emergence as one of the fastest-growing economies in the cryptocurrency space.

According to Matt Mena, a crypto research strategist at 21Shares, the revenue figures were disclosed in a blog post published recently, emphasizing the network’s ability to thrive, even as the speculative frenzy surrounding memecoins has begun to dissipate. Mena characterized the financial performance of Solana as “remarkably strong,” indicating that the network is evolving beyond the speculative trends that once dominated the market.

Mena attributes Solana’s robust performance to its diverse range of activities. The network encompasses decentralized exchanges, trading tools, lending applications, digital wallets, and burgeoning sectors like decentralized physical infrastructure networks (DePIN) and artificial intelligence (AI)-powered applications. This broad spectrum of services has significantly contributed to network fees and overall usage.

Notably, trading tools such as Photon and Axiom have stood out as key revenue drivers, generating approximately $1.12 billion—39% of Solana’s total revenue. However, Mena stressed that it is the platform’s diversity that primarily underpins its current value rather than reliance on a single trend, enabling sustained engagement from users.

Even after the peak activity that characterized late 2024, Solana’s monthly revenue has stabilized, consistently ranging between $150 million and $250 million. This stability suggests a persistent demand for blockspace and ongoing utilization beyond mere speculative activities.

In a comparison of financial performance, Mena noted that Solana is now nearing the scale of significant Web2 platforms, pointing out that its total revenue closely matches that of Palantir, which reported $2.8 billion, and Robinhood, with $2.95 billion in 2024. This juxtaposition underscores Solana’s rapid monetization and maturation within the digital economy.

Mena went on to compare Solana’s progress with that of Ethereum, which, four to five years post-launch, averaged revenues of under $10 million per month. This highlights Solana’s accelerated path to monetizing on-chain activities, significantly aided by its high throughput, low transaction costs, and an expanding ecosystem that encourages adoption.

Looking ahead, Mena suggests that Solana is moving from a phase of mere resilience to one of readiness for future growth. He pointed to upcoming technical enhancements, including Firedancer and Alpenglow, aimed at boosting speed and scalability. These advancements are expected to pave the way for increased institutional involvement in the Solana network.

In Mena’s words, “Solana is no longer an experiment.” The network has established itself as a fully operational digital economy with substantial staying power, showcasing the potential for long-term success in the evolving landscape of cryptocurrency.