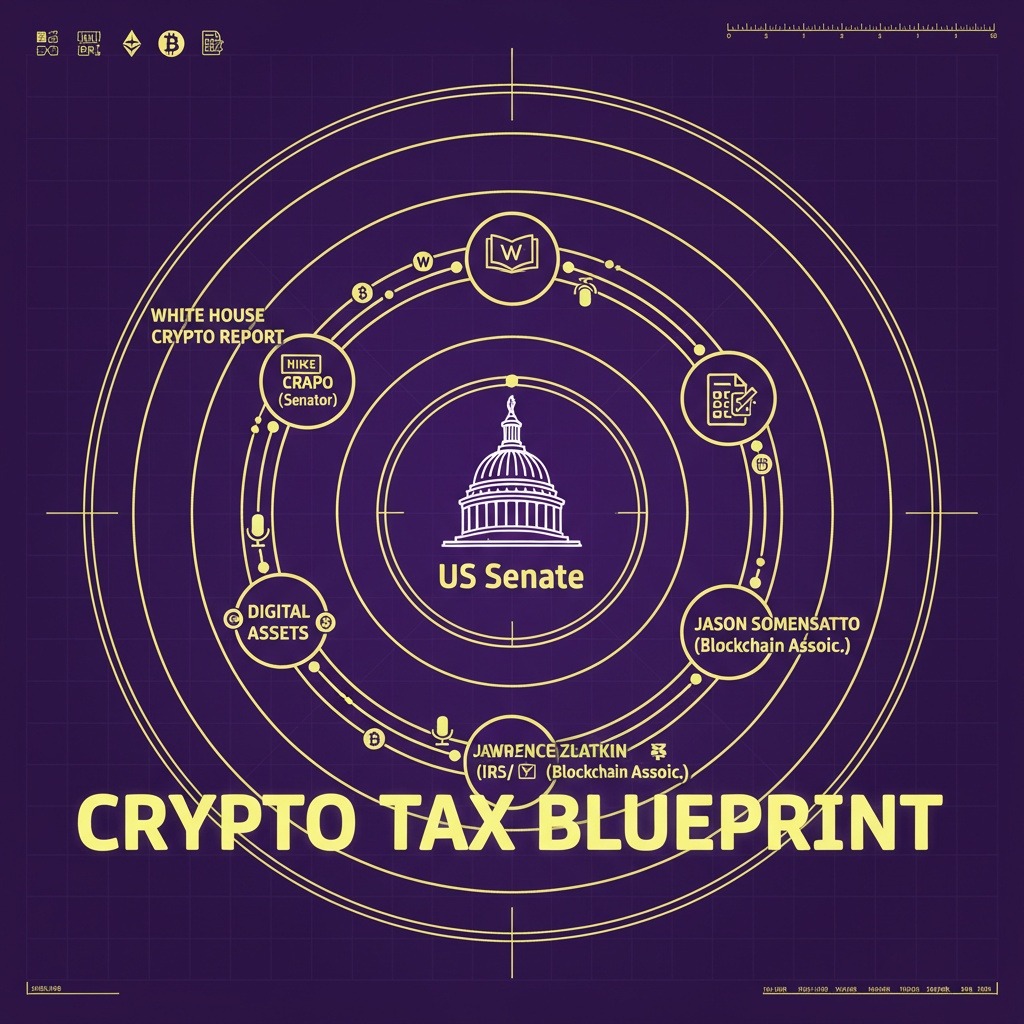

The United States Senate Finance Committee is gearing up to address the taxation of digital assets in a hearing scheduled for Wednesday of next week. This discussion arrives on the heels of a comprehensive report on cryptocurrencies published by the White House Digital Asset Working Group in July, which urged lawmakers to create specific tax frameworks tailored for the unique characteristics of digital assets.

Chairman Mike Crapo will lead the proceedings, which will feature testimony from key figures in the cryptocurrency tax landscape. Among those speaking will be Lawrence Zlatkin, the Vice President of Tax at Coinbase, alongside Jason Somensatto, the Policy Director at Coin Center. Their insights aim to guide lawmakers in determining how to effectively implement taxation policies for cryptocurrencies.

The July report emphasized the need for regulatory measures that view digital assets as a distinct class of property, separate from traditional securities and commodities. In absence of new legislation, the report requested that the Treasury Department and the Internal Revenue Service (IRS) provide clarifying guidance on the taxation of stablecoin transactions and the implications of minor crypto earnings derived from activities such as airdrops, mining, and staking.

The IRS currently categorizes cryptocurrencies and non-fungible tokens (NFTs) as property rather than currency, which means that any transactions involving these digital assets may trigger a capital gains tax if they are sold at a profit. This regulatory approach remains a contentious topic as lawmakers strive to balance innovation with compliance in the rapidly evolving crypto space.

With an increasing focus on crypto regulation since the return of the Trump administration to office in January 2025, there is a concerted effort to foster innovation and retain talent within the United States. Conversely, the Biden administration’s policies have left many operators seeking clarity, particularly regarding tax obligations, which have been a significant area of confusion for industry participants.

The Finance Committee will also hear from Annette Nellen, who serves as chair of the Digital Assets Tax Task Force at the American Institute of Certified Public Accountants. Additionally, Andrea S. Kramer, a founding member of the Chicago-based ASKramer Law and an expert in crypto taxation, will contribute to the discussions.

One prominent voice in the discussion is Senator Cynthia Lummis, who has been vocal about what she deems as the “unfair tax treatment” faced by crypto miners and stakers. Lummis argues that these individuals are effectively taxed twice: first upon receiving their block rewards, and then again when they sell these rewards for profit. “It’s time to stop this unfair tax treatment and ensure America is the world’s Bitcoin and Crypto Superpower,” Lummis expressed in a tweet back in late June.

Despite her efforts to amend Trump’s budget reconciliation bill with provisions addressing these concerns, Lummis’s proposals did not garner the necessary support to be included before the bill was passed. The upcoming hearing aims to rekindle discussions surrounding these crucial issues and pave the way for a more comprehensive understanding of how cryptocurrency and blockchain innovations can be integrated into the existing tax framework.

As the Senate Finance Committee prepares for this important dialogue, the implications of the discussions may set the stage for a more defined regulatory landscape for cryptocurrencies in the United States.