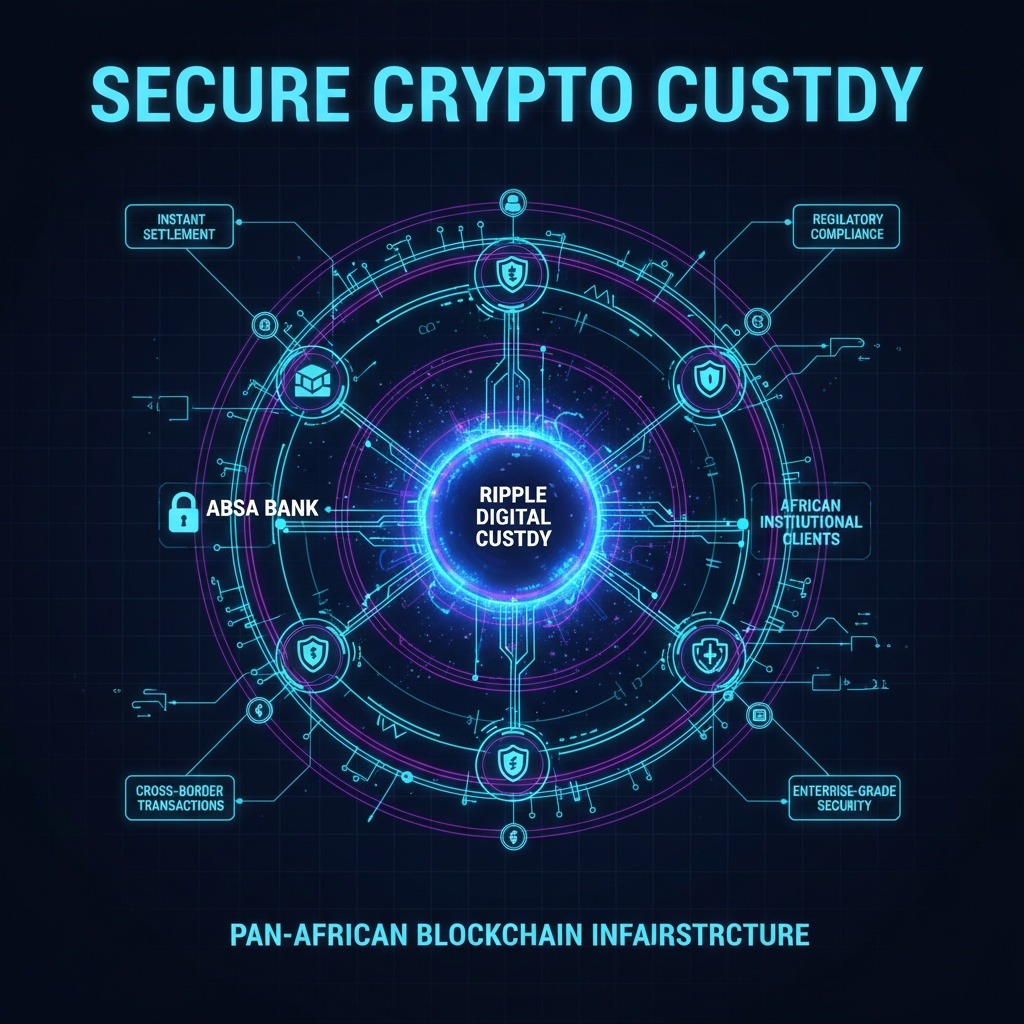

Ripple, a leading blockchain technology provider, is advancing its institutional digital asset custody services into the African market through a strategic alliance with Absa Bank, one of South Africa’s foremost financial institutions.

This partnership marks Absa as Ripple’s inaugural major custody client on the continent, underscoring a growing institutional appetite for secure management of tokenized assets in emerging markets. Utilizing Ripple’s advanced digital asset custody infrastructure, Absa will be able to offer its clientele secure, regulated storage and management solutions for cryptocurrencies and other tokenized holdings.

The integration comes at an opportune moment as regulatory frameworks for digital assets in Africa become clearer and more supportive. This environment enhances confidence for traditional financial establishments to engage with blockchain-based financial products.

Ripple’s custody service, originally launched earlier in 2025, is designed to serve regulated entities looking for robust, compliant blockchain infrastructure. Prior to this African expansion, Ripple’s custody platform has been adopted by institutions across Europe, Asia, and Latin America.

The collaboration with Absa builds upon Ripple’s broader African engagement, including its cooperation with fintech startup Chipper Cash to facilitate cryptocurrency-enabled payments. Additionally, Ripple’s USD-backed stablecoin, RLUSD, is being introduced to several African markets, providing a new stable digital currency option within the region.

According to Ripple’s 2025 New Value Report, a significant 64% of finance leaders in the Middle East and Africa identify expedited settlement times and lower transaction costs as key motivators for integrating blockchain-based currencies into payment systems. Ripple’s extensive regulatory compliance, with over 60 licenses and registrations worldwide, positions it well to address the cautious stance some banks maintain toward digital asset exposure.

The Absa agreement is set to position South Africa as one of the select African countries with a major bank-supported crypto custody solution. This development highlights a meaningful step towards mainstream institutional adoption of digital assets on the continent.

By extending its custody network to Africa, Ripple demonstrates a continued commitment to expanding blockchain infrastructure accessible to regulated financial institutions globally.