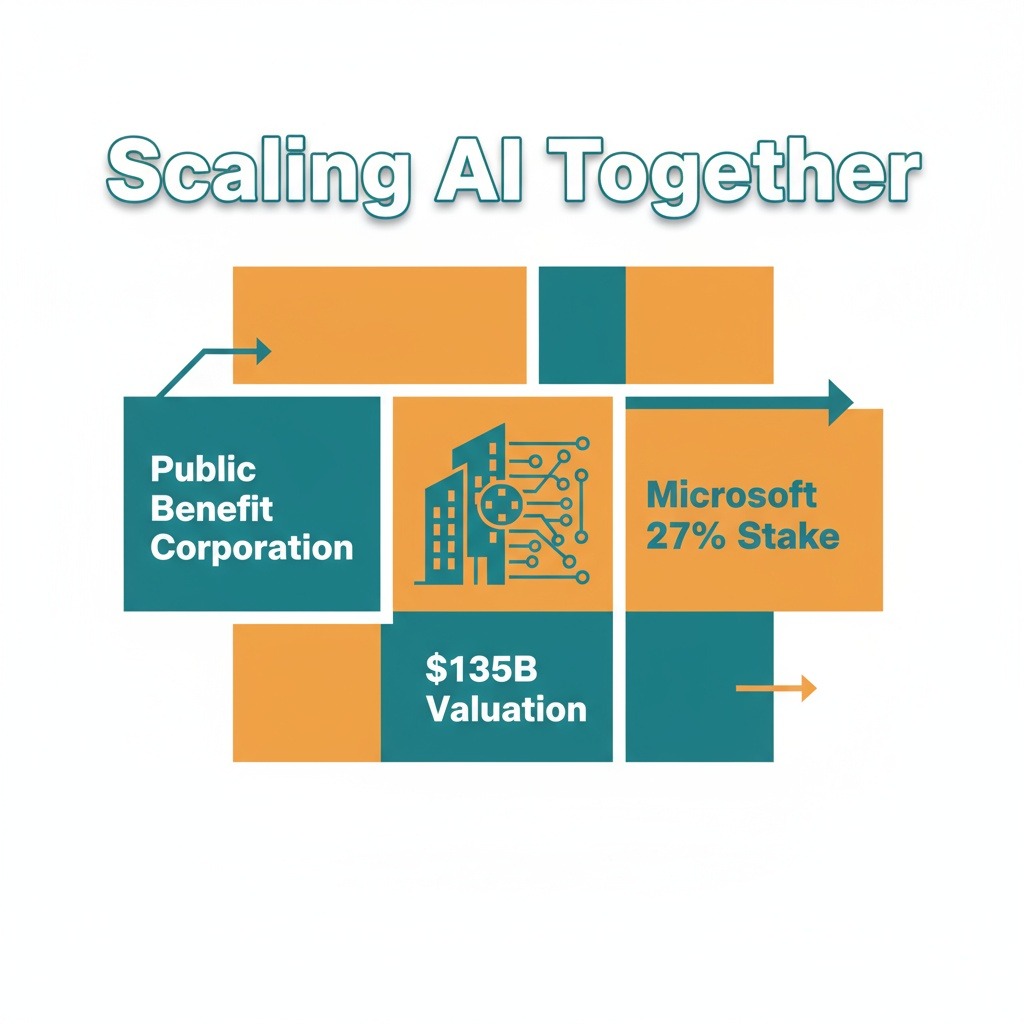

OpenAI, the artificial intelligence organization famed for creating ChatGPT, has shifted its corporate structure to a public benefit corporation. This strategic move is intended to provide the company with enhanced ability to attract investment while advancing its AI development goals.

According to The Wall Street Journal, the restructuring grants Microsoft a 27% ownership interest in the newly formed entity, valuing OpenAI at approximately $135 billion. The partnership between the two tech giants has also been extended, ensuring that Microsoft retains privileged access to OpenAI’s core AI technologies for the next seven years.

As part of this agreement, OpenAI has committed to spending around $250 billion on Microsoft’s Azure cloud services across the duration of their collaboration. This substantial investment further cements the close strategic and financial ties between the companies, highlighting the pivotal role Microsoft plays in supporting OpenAI’s infrastructure and growth.

A public benefit corporation structure allows OpenAI to operate as a for-profit company while maintaining focus on its stated public mission. It enables the company to raise capital, issue equity, and generate returns for investors without abandoning the pursuit of broader societal benefits.

Despite this revised corporate status, criticism from figures such as Elon Musk persists. Musk has expressed concerns that OpenAI’s transformation from a nonprofit to a profit-driven entity represents a departure from the organization’s original mission to develop AI for the public good.

ChatGPT remains the leading large language model worldwide, boasting an estimated 800 million weekly active users according to industry metrics. Its capabilities have expanded well beyond conversational AI, increasingly influencing automated trading systems in both the cryptocurrency and traditional financial markets.

These AI-powered trading bots utilize ChatGPT’s ability to analyze complex market data, identify patterns, and adapt strategies in real time. This integration reinforces the model’s growing impact on fintech and crypto trading sectors, as documented by Cointelegraph.

Recent comparative research tested several large language models specifically designed for cryptocurrency trading. The study revealed that Grok, developed by X, and DeepSeek, a prominent Chinese AI model, outperformed both ChatGPT and Google’s Gemini in simulated trading environments. The experiment began with each bot managing an initial capital of $200, scaling up to $10,000 per model. Transactions were executed on Hyperliquid, a decentralized exchange platform.

This development illustrates the rapidly evolving AI landscape, with new models increasingly competing to optimize digital asset trading strategies.

In related cloud computing news, a recent Amazon AWS outage impacted popular financial platforms including the Coinbase mobile app and Robinhood, highlighting ongoing challenges around infrastructure reliability in the digital economy.