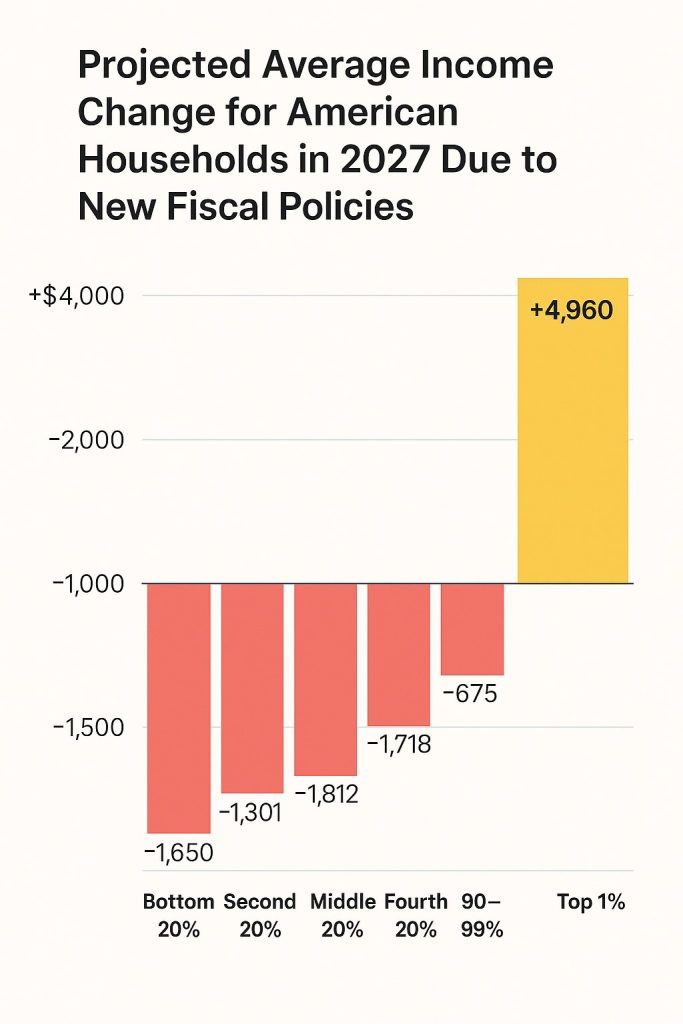

The landscape of American fiscal policy is shifting dramatically under the Trump administration’s latest proposals, igniting a firestorm of debate and concern among economists and citizens alike. A recent report from the Center for American Progress reveals that these new policies could significantly diminish incomes for the vast majority of Americans while providing the top 1% with a substantial windfall. Notably, the analysis predicts a net income increase of nearly $5,000 for this affluent minority by 2027, leaving broader households to grapple with potential losses.

According to the report, as detailed in a striking bar chart, the projected average income change for American households illustrates a chilling trend. Households earning below $100,000 annually are expected to experience declines in income by 2027. In contrast, the wealthiest individuals, earning over $500,000 a year, stand to gain substantially from the proposed fiscal changes.

The Dismal Forecast

The analysis uncovers that individuals and families making between $30,000 to $50,000 annually could see decreases of up to $1,200, while those in the $50,000 to $100,000 bracket may suffer losses exceeding $2,000. Such declines raise significant concerns about the administration’s priorities and the sustainability of American economic growth for middle and working-class families.

Critics of the administration argue that these policies perpetuate an era of increasing inequality, wherein the wealthy gain more wealth at the expense of the broader populace. Adam Green, a spokesperson for the Center for American Progress, emphasized that these proposals serve a narrow interest, “The administration’s clear favoritism towards the wealthiest Americans pushes millions of hardworking families further away from financial stability.”

Impact on Economic Inequality

This anticipated economic shift could exacerbate existing inequalities, particularly as essential costs such as healthcare and housing continue to rise across the country. In a time when many Americans are still recovering from the financial impacts of the pandemic, policies that cater to ultra-high-income earners threaten to widen the gap between the rich and poor.

The administration has defended its strategies by claiming that tax relief for businesses and high earners will encourage investment and job creation, a theory that many experts argue hasn’t proven effective in past fiscal policies. Critics are skeptical about whether these predicted benefits will translate into real gains for the average American.

The report raises critical questions about the future of economic policy in the U.S. Moving forward, it’s essential to scrutinize how policy changes directly influence the financial well-being of all demographics, especially as many households face stagnation in wages and rising living costs.

As discussions around the implications of these policies continue, Americans remain vigilant, eager to understand how legislative changes can impact their financial futures.

Where to Learn More

- New Trump Administration Policies Will Decrease Average Incomes for All Americans Except the Top 1% – Center for American Progress

- How the Rich Get Richer Under Trump’s Tax Proposals – Bloomberg

- US Inequality Is Worsening – The Economist

- A Look at the Trump Administration’s Economics: What It Means for the Middle Class – Forbes