In an age where online shopping and luxury treats are just a click away, stories of immediate buyer’s remorse are capturing the attention of social media users worldwide. Recently, a viral trend titled “Months of saving: 50 times people instantly regretted spending money” has surged across platforms, sparking widespread empathy—and chuckles—from followers who know the sting of regretted splurges all too well.

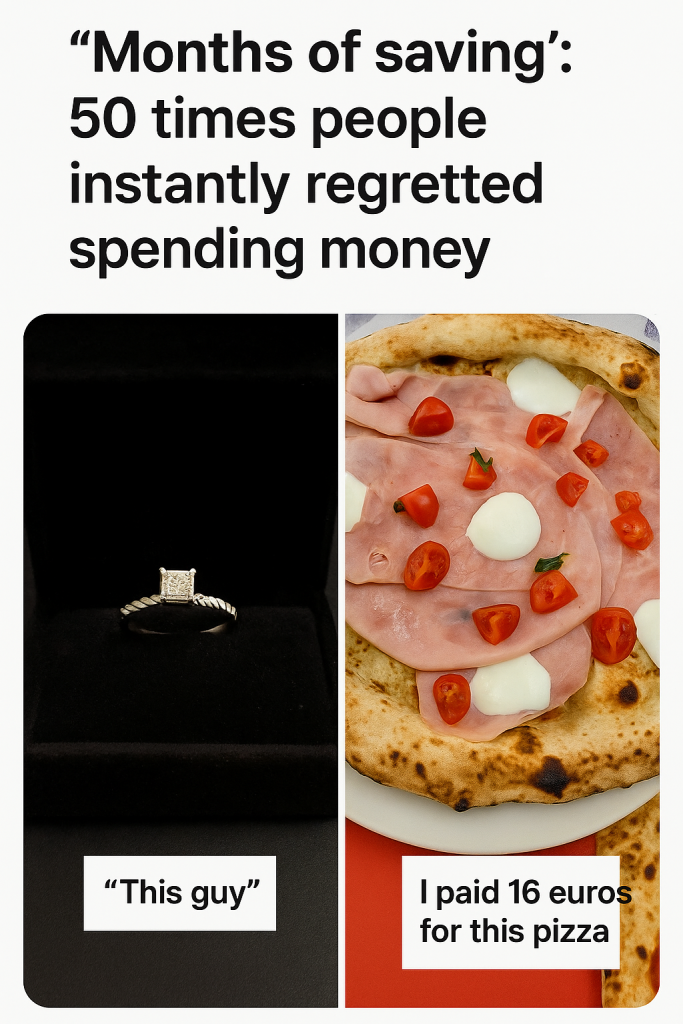

The trend features compiled stories and images from people who poured months—sometimes years—of saving into purchases that brought sudden disappointment or confusion. The posts often include a snapshot of the high-priced item, with captions expressing how the long-awaited joy fizzled the moment the transaction was complete.

One of the most shared examples involves a man who paid 16 euros for a pizza, only to instantly regret the cost when faced with the underwhelming portion. “I paid 16 euros for this pizza,” the post reads alongside a photo of a small, sparsely topped pie — hardly a feast worthy of the steep price tag. The post tapped into a common frustration over overpriced food and the deceptive allure of “gourmet” products.

Other viral stories profile buyers who spent upwards of $1,500 to $2,000 on items ranging from electronics to designer goods, only to later question whether the expenditure was worth it. One dramatic example shows a man investing heavily in high-tech headphones, only to find them uncomfortable and prone to technical issues shortly after purchase. The caption simply states, “This guy… months of saving for this?”—a sharp yet relatable commentary on the realities of expensive tech gear.

Consumer psychology experts suggest that instant buyer’s remorse often stems from the contrast between the anticipation that builds during the saving process and the reality of the experience after the purchase. The excitement of finally obtaining a prized item can give way to disappointment if the product fails to meet expectations or if the buyer feels the price was unjustified.

Economists warn that such experiences highlight the importance of mindful spending, especially when it involves big-ticket items. While saving up can be financially responsible, the emotional investment—expecting happiness or status from an expensive purchase—can sometimes cloud judgment. In online communities, users share stories as a form of social support, reminding others that they are not alone in their financial missteps.

The viral posts also touch on cultural attitudes towards money and material possessions. In many cases, the regret comes from realizing that the item purchased doesn’t enhance one’s life as hoped, raising questions about consumerism and value beyond just price tags. The emphasis shifts from mere ownership to the real utility or satisfaction derived, encouraging reflection before future purchases.

Despite the humor often infused in these confessions, the trend has a deeper resonance. It encourages a critical look at spending habits in today’s marketplace saturated with influencer endorsements, flashy packaging, and “must-have” marketing pressure. The stories are a candid reminder that not all that glitters is gold—sometimes it’s just a pricey regret.

If there’s a takeaway from the “Months of saving” trend, it is simple yet powerful: financial goals are important, but so is evaluating what truly brings lasting value. Whether it’s that 16 euro pizza or a $2,000 gadget, not every splurge delivers happiness—and that realization is something many consumers are navigating together in 2024’s dynamic spending landscape.