In a significant development for cryptocurrency adoption in Bolivia, three global automotive giants—Toyota, Yamaha, and BYD—have begun accepting Tether (USDT) as a payment method. This move aims to address the nation’s dwindling US dollar reserves, illustrating a shift towards digital currencies in the South American country.

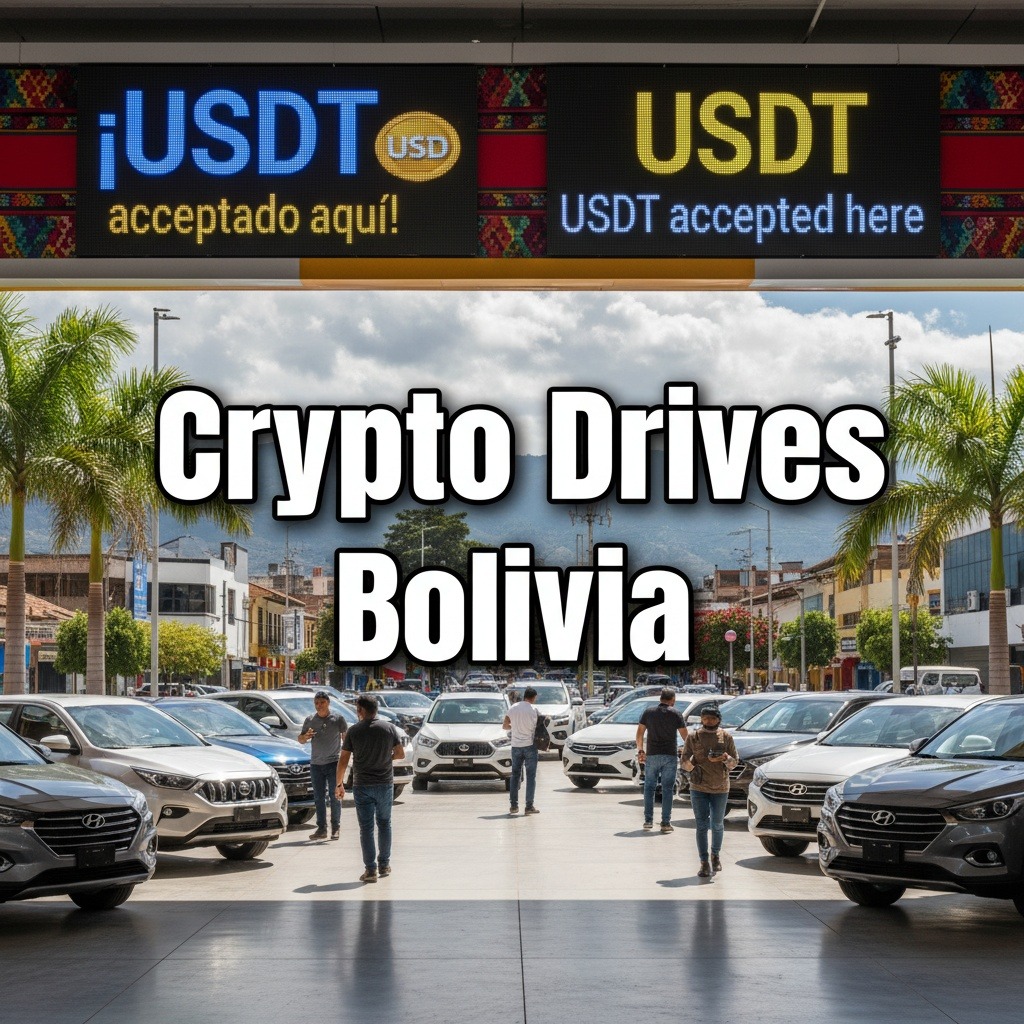

Paolo Ardoino, CEO of Tether, announced this milestone on Sunday, marking a pivotal moment in Bolivia’s financial landscape. The announcement follows the confirmation from crypto security firm BitGo that a Toyota vehicle was purchased using USDT just one day prior. Ardoino shared images depicting a local dealership showcasing advertisements for USDT, promoting it as an “easy, fast, and safe” option for buyers.

This shift comes on the heels of Bolivia lifting its long-standing ban on cryptocurrencies in June 2024, allowing banks to conduct transactions involving Bitcoin (BTC) and stablecoins. Notable developments in this realm began in March when Yacimientos Petrolíferos Fiscales Bolivianos, the state-owned oil and gas company, received government authorization to accept cryptocurrency for fuel imports, aiming to mitigate the nation’s growing US dollar shortages.

According to Trading Economics, Bolivia’s foreign currency reserves have plummeted 98 percent from $12.7 billion in July 2014 to just $171 million as of August 2023. While the local currency, the boliviano, is still the most widely used, many Bolivians are increasingly drawn to more stable assets like the US dollar or cryptocurrencies due to concerns about inflation and purchasing power erosion.

In a sign of the country’s evolving economic landscape, Bolivia’s top financial institution acknowledged cryptocurrencies as a “viable and reliable alternative” to traditional fiat currencies. This endorsement was formalized in July through a memorandum with El Salvador, aimed at accelerating the adoption of digital currencies across Bolivia.

In another adaptive measure, shops at Bolivian airports have begun pricing everyday items in USDT to navigate the ongoing currency crisis. Gabriel Campa, TowerBank’s head of digital assets, reported that Bolivian businesses involved in importing goods have been using USDT to sidestep the scarcity of US dollars. According to Campa, these businesses procure stablecoins locally or through offshore accounts, convert them to US dollars, and use them to pay international suppliers, creating a stablecoin economy that supports trade and operational stability.

Looking ahead, Bolivia is set for a significant political decision on October 19, when voters will participate in a run-off election between Rodrigo Paz Pereira from the Christian Democratic Party and Jorge “Tuto” Quiroga representing the Freedom and Democracy alliance. Paz Pereira has advocated for utilizing blockchain technology to combat corruption, while Quiroga’s stance on cryptocurrency remains unclear. The outcome of this election will be crucial, as it will determine Bolivia’s trajectory after years under the Movement for Socialism, which has faced considerable scrutiny for the country’s economic challenges.

The evolving landscape of crypto adoption in Bolivia, especially the acceptance of USDT by major industries, indicates a notable shift away from traditional currency dependence, as the nation seeks innovative solutions to its financial issues.