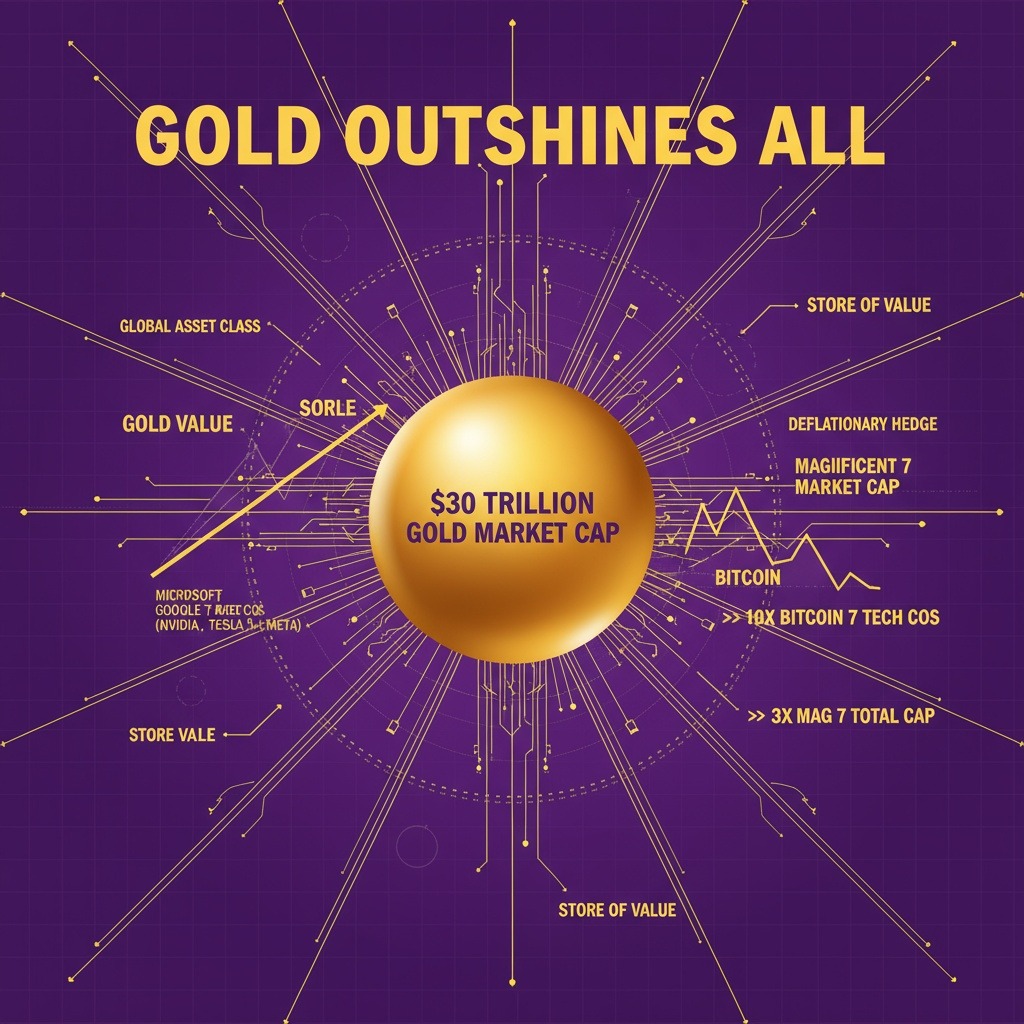

Gold’s market capitalization surged to an unprecedented $30 trillion on Thursday, propelled by the precious metal reaching a record price of $4,357 per ounce. This historic milestone further solidifies gold’s position as a dominant store of value in global markets.

To put this into perspective, gold’s market cap is now approximately 14.5 times larger than Bitcoin’s, which stands at around $2.1 trillion. Additionally, gold’s valuation exceeds the combined market capitalization of the so-called “Magnificent 7” technology giants—including Nvidia, Microsoft, Apple, Alphabet, Amazon, Meta, and Tesla—by roughly 1.5 times. Together, these leading tech companies hold a combined market worth of about $20 trillion.

It is important to note that gold’s market capitalization is calculated differently from that of companies. While corporate market caps are based on their outstanding shares, gold’s market cap represents the total value of all the gold ever mined throughout history, an estimate rather than an exact figure due to the difficulty in measuring all existing reserves.

In 2024, gold has experienced significant price appreciation, rallying more than 64% since the start of the year. This surge is driven by various macroeconomic factors, including concerns over the weakening U.S. dollar, ongoing geopolitical uncertainty, and rising trade tensions worldwide. Gold has more than doubled its value since early 2024, reflecting strong demand from investors seeking a safe haven asset.

In the cryptocurrency space, Bitcoin has been widely viewed as “digital gold.” Market watchers note that Bitcoin’s current market cap and price gains, while positive, have not kept pace with gold’s dramatic surge. Bitcoin is up approximately 16% since January 1 but remains some 14% below its all-time high.

Crypto analyst Sykodelic highlighted this growing discrepancy, pointing out that gold added over $300 billion to its valuation in a single day, an increase roughly equivalent to the entire market cap of Bitcoin each week. This remarkable growth underscores the scale and influence of gold in the wider financial ecosystem.

Some industry experts suggest that shifts in capital allocation could eventually occur as gold’s rally stabilizes, potentially benefitting Bitcoin given its reputation as a digital alternative to gold. Meanwhile, venture investor Joe Consorti commented on Bitcoin’s potential to decouple from traditional equity markets and noted the importance of geopolitical factors in shaping investor behavior.

Market analyst Merlijn the Trader observed a notable divergence between surging global M2 money supply, soaring gold prices, and relatively subdued Bitcoin performance. He emphasized that such divergences tend to be temporary, with liquidity generally moving toward higher-risk assets over time, possibly setting the stage for future Bitcoin gains.

As gold reaches new heights in market capitalization, the interplay between traditional safe-haven assets and digital currencies like Bitcoin continues to attract attention from investors contemplating portfolio diversification amid ongoing global economic challenges.