The FTX Recovery Trust, the organization tasked with distributing funds from the defunct crypto exchange, has announced its plans to release a significant third tranche of payments to creditors, totaling approximately $1.6 billion. This distribution is set to occur on September 30, 2023, with funds expected to reach creditors’ accounts within three business days following the payment date.

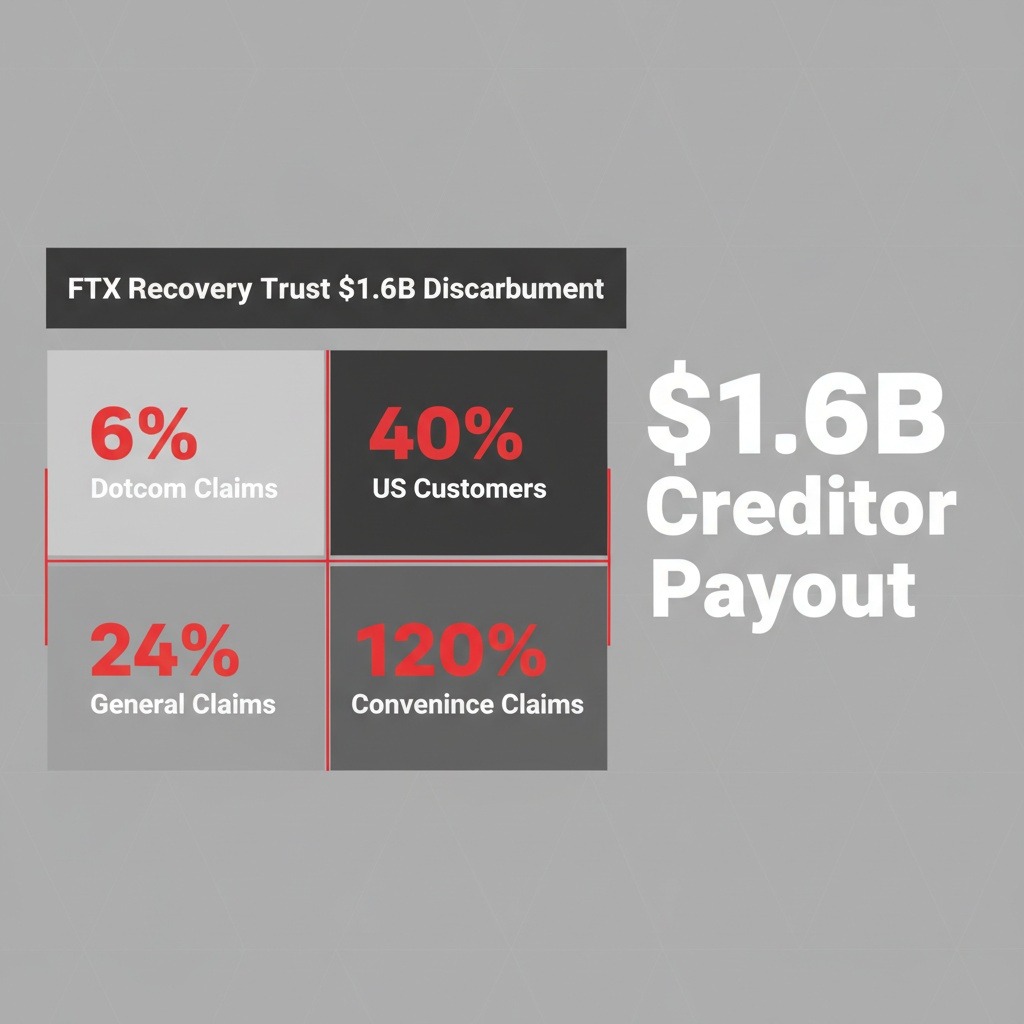

This round of disbursements will see diverse allocations for various types of claims, including a 6% payout to Dotcom Customer claims, a 40% distribution for US Customer Entitlement Claims, and a 24% distribution for General Unsecured Claims along with Digital Asset Loan Claims. Notably, those holding convenience claims are poised to receive a 120% reimbursement as part of this September distribution.

The FTX Recovery Trust has taken significant strides in the past year to reimburse affected creditors, beginning its payout journey in February with an initial distribution of $1.2 billion, followed by a much larger allocation of $5 billion in May. Currently, the trust holds assets amounting to $16.5 billion earmarked specifically for compensating creditors and former customers.

The downfall of FTX, which occurred in late 2022, sent ripples throughout the cryptocurrency space, exacerbating an already challenging bear market that had begun earlier that year. As creditors await their reimbursements, analysts and investors are closely observing how these distributions may influence the broader crypto markets.

Adding to the backdrop of the FTX saga, former CEO Sam Bankman-Fried, commonly referred to as SBF, was convicted in November 2023 on multiple counts, including wire fraud and money laundering conspiracy. Following his conviction, he was sentenced to 25 years in prison in March 2024. The presiding Judge Lewis Kaplan described the circumstances surrounding the exchange’s collapse and Bankman-Fried’s involvement as serious offenses that warranted substantial prison time.

Currently, Bankman-Fried’s legal team is preparing to appeal his conviction in November. They contend that the trial did not provide a fair assessment, suggesting that their client faced bias from the outset. They have also posited that FTX was not insolvent at any point and that there were sufficient funds available to fulfill reimbursement obligations to customers and creditors alike.

As the FTX Recovery Trust continues its operations, the broader cryptocurrency community remains alert, hoping for a resolution that could potentially stabilize the market in light of the recent upheaval. The upcoming distribution is seen as a pivotal moment for many affected by the exchange’s downfall, giving hope to those who have been waiting for financial restitution.