Ethereum (ETH) is showing signs of potential further decline as institutional support wanes and technical indicators signal bearish momentum. Over the past month, Ether’s price has dropped approximately 14%, slipping from above $4,000 to around $3,724 as of Monday. This downturn comes alongside declining inflows into spot Ethereum exchange-traded funds (ETFs) and weakening demand among major holders.

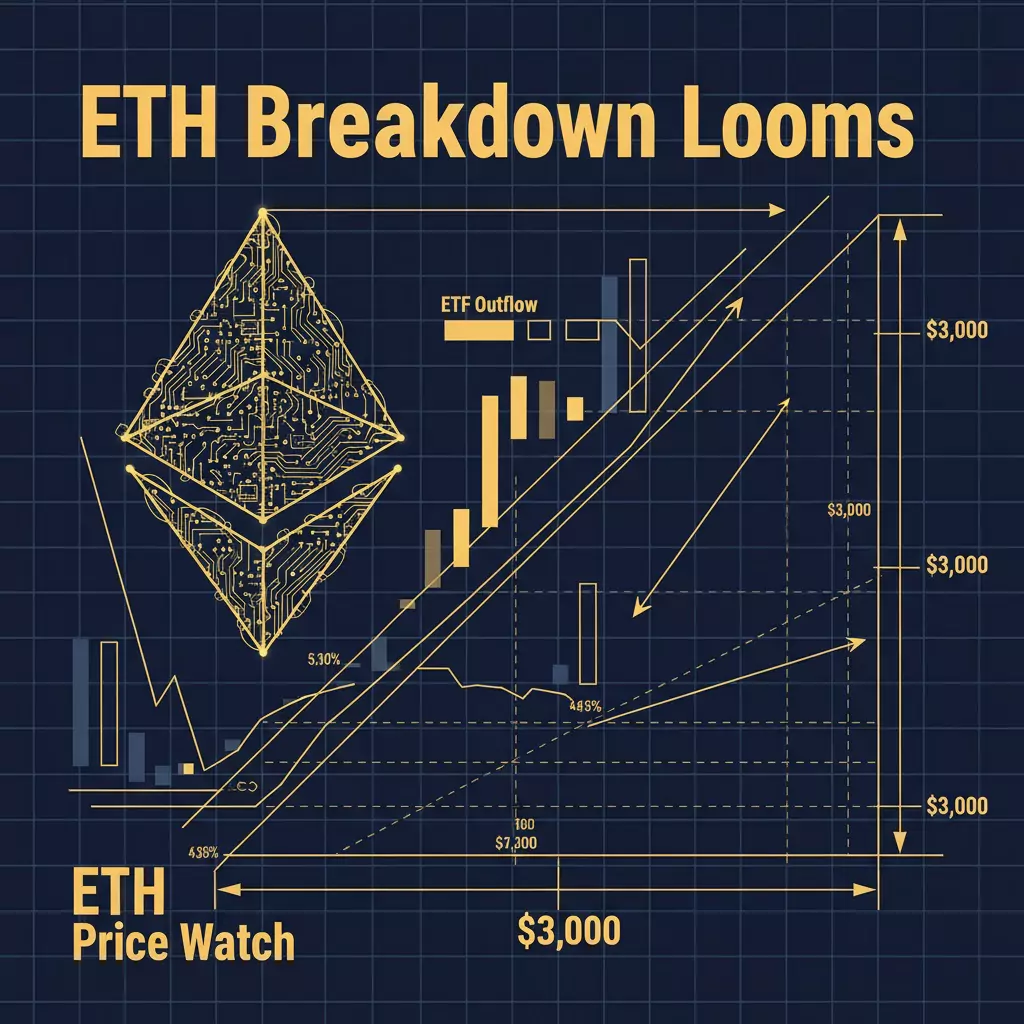

ETF outflows weigh on Ether

Data from SoSoValue reveal that U.S.-based spot Ether ETFs have experienced outflows for three straight days, with a cumulative withdrawal surpassing $360 million. This pullback in capital reflects a broader trend of risk aversion among investors, who are reallocating assets away from Ethereum-focused investment vehicles. Meanwhile, newly launched spot Solana ETFs have seen inflows, suggesting a rotation of institutional funds within the altcoin market.

Additional insights from StrategicETHreserve.xyz indicate that since mid-October, the total Ether held in strategic reserves and ETF funds has decreased by more than 124,000 ETH. This decline points to a reduction in demand from institutional and corporate holders, raising concern about the sustainability of current price levels. Analyst Ted Pillows highlighted that most treasury entities are liquidating holdings, with BitMine standing out as a rare buyer. He also noted that ongoing selling pressure could exhaust treasury buying power, making a notable price rebound unlikely in the near term.

Technical patterns predict further pullback

Ethereum’s price action on the eight-hour chart has formed a descending triangle pattern since early October, a technical shape often indicative of a bearish reversal. This pattern is characterized by a horizontal support line coupled with a downward-sloping resistance, suggesting diminishing buying strength. The setup typically forecasts a breakdown below support followed by a price drop equivalent to the triangle’s height.

Crypto analyst CryptoBull_360 noted that ETH recently broke beneath this triangular pattern and is currently retesting the breakdown level. A successful retest may validate the continuation of the downward trend. Based on the pattern’s measurements, Ethereum could see its price fall to around $2,870—a roughly 22% decrease from current levels.

Adding to the bearish outlook is the SuperTrend indicator, which switched from a bullish state (green) to bearish (red) last week, moving above the ETH price line. This tool, which incorporates the average true range to assess market trends, gave a similar sell signal on October 7. Following that signal, Ethereum’s price declined about 22% from $4,750 to $3,700.

Support levels under scrutiny

Analysts emphasize that Ethereum’s ability to hold key support near $3,700 is crucial. Failure to maintain this level could push prices toward $3,500 or even lower, potentially extending losses further. Recovery above the $4,000 mark would be integral to reversing the current downtrend.

While these indicators point toward continued softness in the near term, market participants should remain attentive to changes in institutional activity and technical signals that may alter Ethereum’s trajectory.

This report does not constitute investment advice. Trading and investment decisions carry inherent risks, and readers are encouraged to perform independent research before making any financial moves.