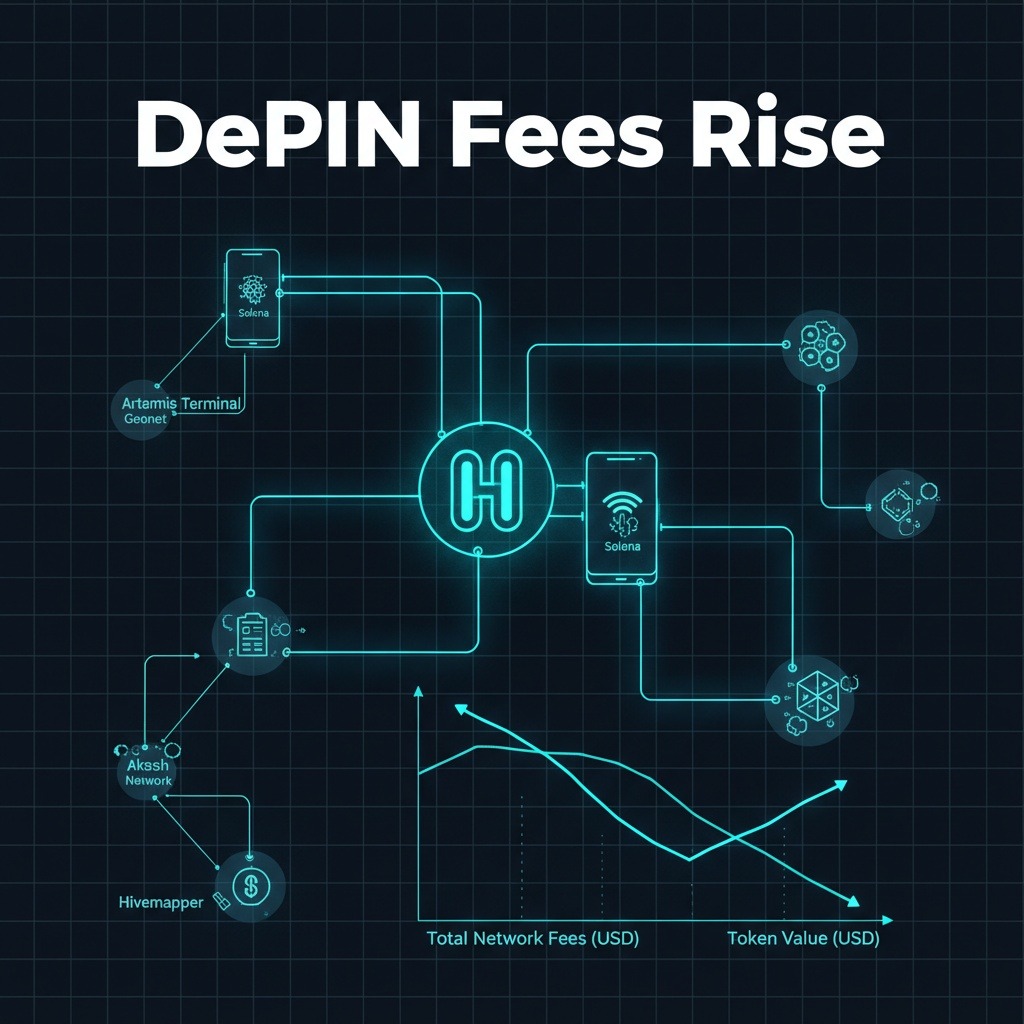

The decentralized physical infrastructure (DePIN) landscape is experiencing a notable increase in fee generation, reaching an all-time high even as the market faces a downturn in token values. The uptick in activity has been largely driven by Helium, a leader in the DePIN space, particularly due to its recent collaboration with the Solana Seeker mobile phone.

Since mid-August, the DePIN sector has seen significant momentum, with Helium’s innovative partnership substantially bolstering its fee earnings. Data indicates that over the past five weeks, Helium has consistently generated between $330,000 and $370,000 weekly. This impressive feat accounts for approximately 60% of the overall average fee income within the sector.

Other notable players in the DePIN arena include Geonet, Akash Network, and Hivemapper, which collectively contributed around $181,000 in fees. This group represents roughly 32% of the total fee revenue generated in the last week, showcasing a growing interest in decentralized infrastructure solutions.

Despite the heightened activity and impressive fee generation, the landscape for DePIN project tokens has not mirrored this success. Tokens linked to leading projects like Render, Filecoin, and Helium have experienced significant declines ranging from 40% to 70% over the past year. This divergence between robust activity metrics and declining token performance raises questions about market dynamics within the DePIN sector.

The contrasting fortunes of fee revenues and token values could be attributed to a variety of factors, including market sentiment, regulatory challenges, and the evolving nature of investment strategies in the crypto space. Investors are increasingly focused on utility and real-world applications as the foundation for value, which may not always translate to token market performance.

Nonetheless, Helium’s latest achievements highlight the sector’s evolving landscape and demonstrate a clear demand for decentralized physical infrastructure solutions. As the sector continues to mature, it will be essential for projects to build resilience against volatility and engage effectively with their communities.

The DePIN sector’s strength in fee generation suggests that while the market may be turbulent, the underlying technologies and infrastructure are gaining traction. Efforts to improve user engagement and broaden adoption could play a pivotal role in bridging the current gap between fee performance and token valuation.

As we move forward, stakeholders within the DePIN ecosystem will be keenly observing how market dynamics evolve, especially in light of increasing competition and technological advancements. The synergy between user growth and fee generation will likely be critical in defining the future landscape of decentralized infrastructure as the year progresses.