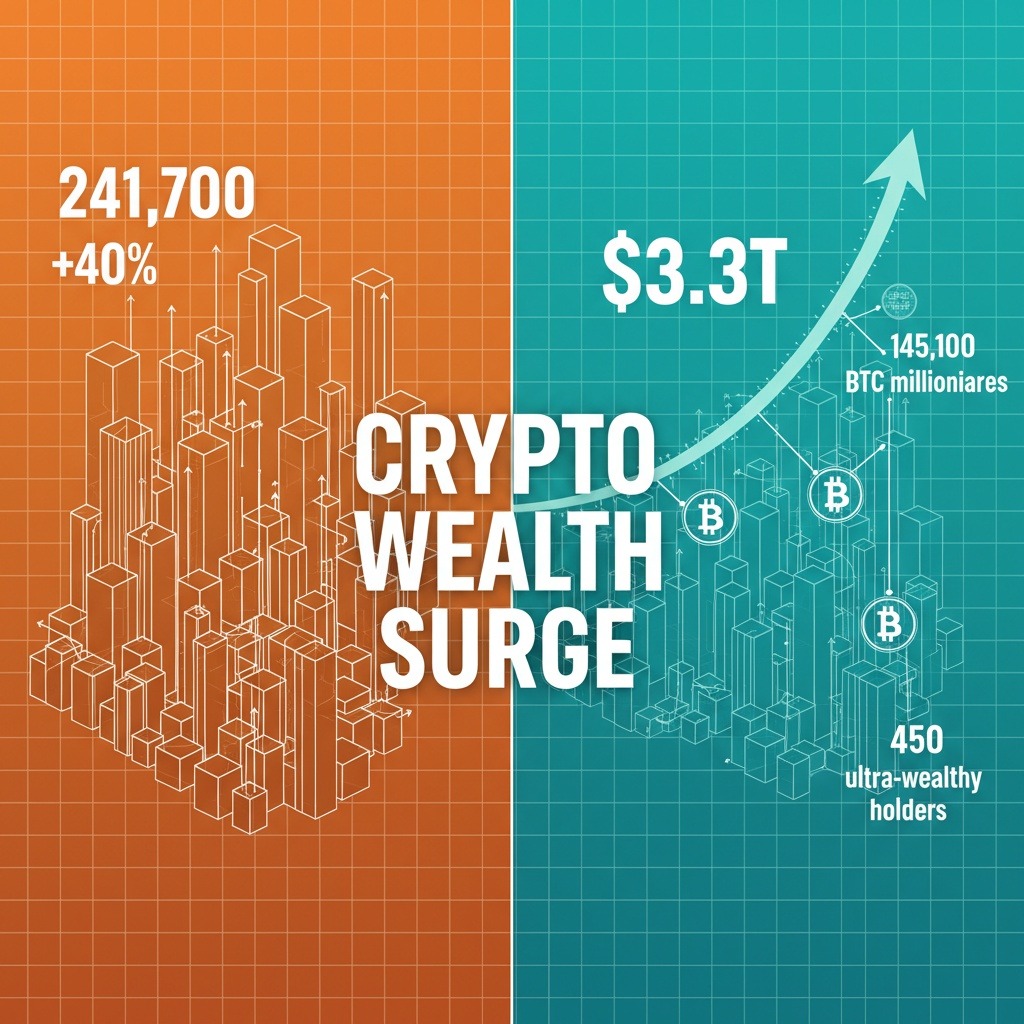

The latest findings from Henley & Partners’ Crypto Wealth Report 2025 reveal a staggering increase in the number of individuals classified as crypto millionaires, with the figure now standing at 241,700—an impressive 40% jump over the past year. This growth in wealth corresponds with a significant rally in the cryptocurrency market, which saw total market capitalization soar to $3.3 trillion by June, marking a 45% year-on-year increase.

Bitcoin remains the dominant force behind this wealth creation in the cryptocurrency sector. The report highlights that the number of Bitcoin holders with portfolios exceeding $1 million has surged by 70%, bringing the total to 145,100. At the upper tier, there are currently 450 individuals holding at least $100 million in crypto assets, while 36 crypto billionaires control even greater fortunes.

As cryptocurrency evolves, its applications are also transforming. The report indicates a shift in how investors are deploying Bitcoin; it is increasingly viewed not just as a speculative asset but as collateral. This change is reshaping Bitcoin into a foundational currency for a parallel financial system, as noted by Philipp A. Baumann, the founder of Z22 Technologies. Baumann remarked, “Bitcoin is becoming the foundation of a parallel financial system, where it is not merely an investment for speculation on fiat price appreciation, but the base currency for accumulating wealth.”

The decentralized character of cryptocurrency is also altering the landscape of global wealth distribution. Analysts point out that investors are actively seeking citizenship and residency programs to effectively navigate the ever-changing regulatory environment while ensuring access to banking services and tax-efficient environments. According to Henley’s annual Crypto Adoption Index, Singapore, Hong Kong, the United States, Switzerland, and the United Arab Emirates rank as the top five favorable locations for digital asset investors.

In 2022 alone, over $14 trillion in wealth was transferred across borders, demonstrating how the portability of cryptocurrencies—often secured with just a seed phrase—represents a significant departure from conventional place-based financial systems. Dominic Volek, Group Head of Private Clients at Henley & Partners, emphasized the importance of this transition, stating, “Today, cryptocurrency has made geography optional — with nothing more than 12 memorized words, an individual can secure a billion dollars in Bitcoin, instantly accessible from Zurich or Zhengzhou alike.”

As cryptocurrencies, especially Bitcoin, continue to gain traction as legitimate financial tools, the landscape for wealth management, investment, and global finance is rapidly evolving. The Crypto Wealth Report serves as a crucial indicator of this dynamic transformation, showcasing the growing influence of digital assets in reshaping global financial narratives.