In a strategic move to enhance its institutional crypto trading capabilities, CoinRoutes, a leading platform tailored for institutional cryptocurrency trading, has announced the acquisition of QIS Risk, a prominent provider of portfolio and risk management solutions for digital asset managers. This transaction, valued at $5 million in cash and stock, was revealed in a press release issued by CoinRoutes on Tuesday.

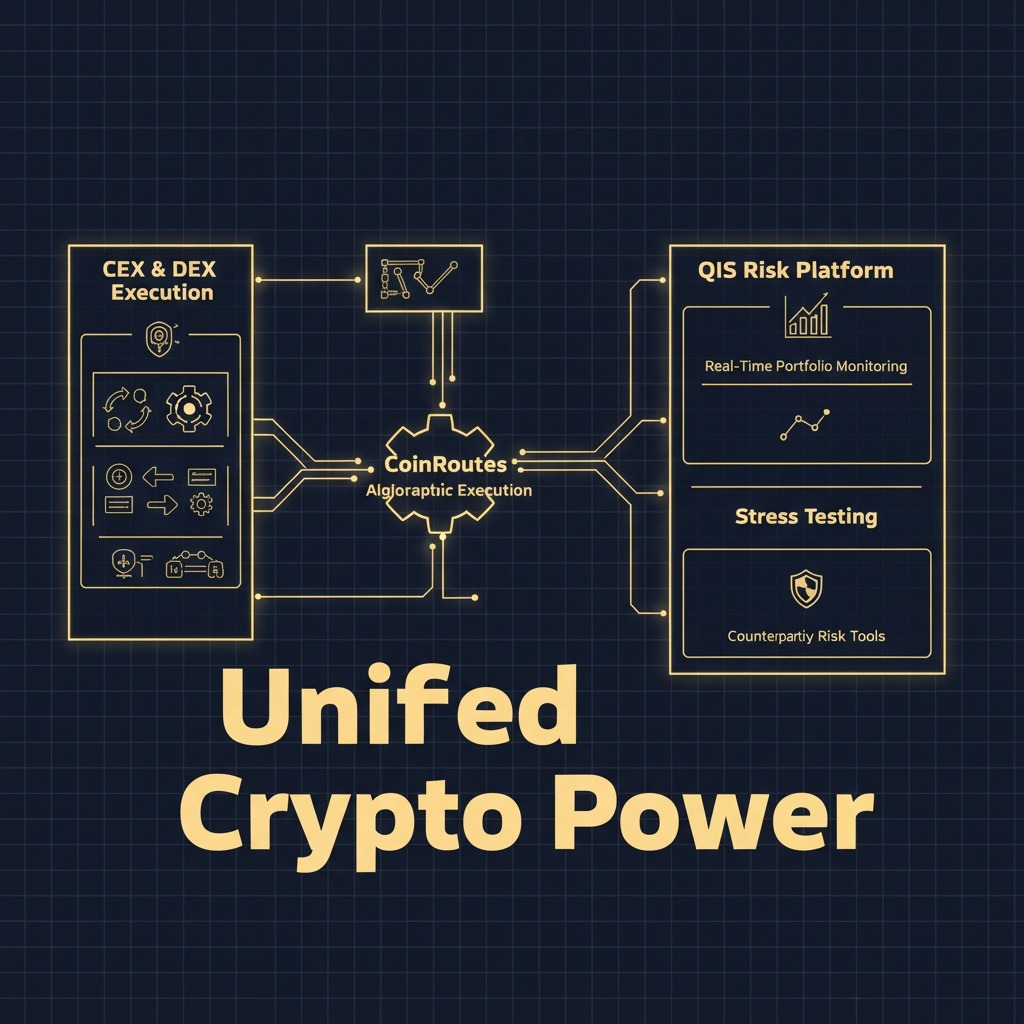

The acquisition signifies the unification of CoinRoutes’ cutting-edge algorithmic execution technology with QIS Risk’s powerful tools for portfolio monitoring and risk analytics. CoinRoutes boasts connectivity to over 50 exchanges and access to more than 3,000 digital assets, while QIS Risk integrates with more than 70 trading sources, delivering real-time tracking and analytical capabilities to its users.

The merger of these two firms is expected to empower institutional clients with a more robust trading platform, enabling execution across centralized exchanges (CEX), decentralized exchanges (DEX), as well as comprehensive tools for portfolio management. Enhanced features will include real-time profit-and-loss monitoring, stress testing, counterparty risk assessment, and options trade capture for platforms like Deribit and over-the-counter (OTC) positions. Furthermore, the integration aims to extend support to decentralized finance (DeFi) markets, incorporating tracking for staking and on-chain derivatives.

As part of the acquisition agreement, Fred Cox, the founder of QIS Risk, will assume the role of Global Chief Technology Officer at CoinRoutes. In this capacity, he will oversee the technology operations and spearhead the firm’s efforts to broaden its influence in the European market. Cox commented on the acquisition, stating, “Digital assets have reached an inflection point where institutions require enterprise-grade infrastructure across the entire investment lifecycle.”

According to Ian Weisberger, CoinRoutes co-founder and CEO, the integration of their execution technology with QIS Risk’s analytics will enable them to deliver a more comprehensive solution for institutional investors. This acquisition comes at a pivotal time as interest from institutional investors in cryptocurrency trading infrastructure is on the rise.

Since its establishment seven years ago by Weisberger and Michael Holstein, CoinRoutes has been a notable player in the cryptocurrency market, processing over $500 billion in executed trades. The company’s execution management system is designed with a strong emphasis on giving clients control over their wallets and private keys while allowing them to tap into liquidity across multiple trading venues. This approach is particularly appealing to institutions that prioritize minimizing counterparty risk.

The union of CoinRoutes and QIS Risk is set to pave the way for a new era in institutional crypto trading, providing the necessary tools and infrastructure that are essential in an evolving market landscape. As the demand for sophisticated trading solutions continues to grow, this acquisition positions CoinRoutes as a formidable player in the ongoing evolution of institutional cryptocurrency trading.