CoinRoutes Expands Offerings with $5M Acquisition of QIS Risk

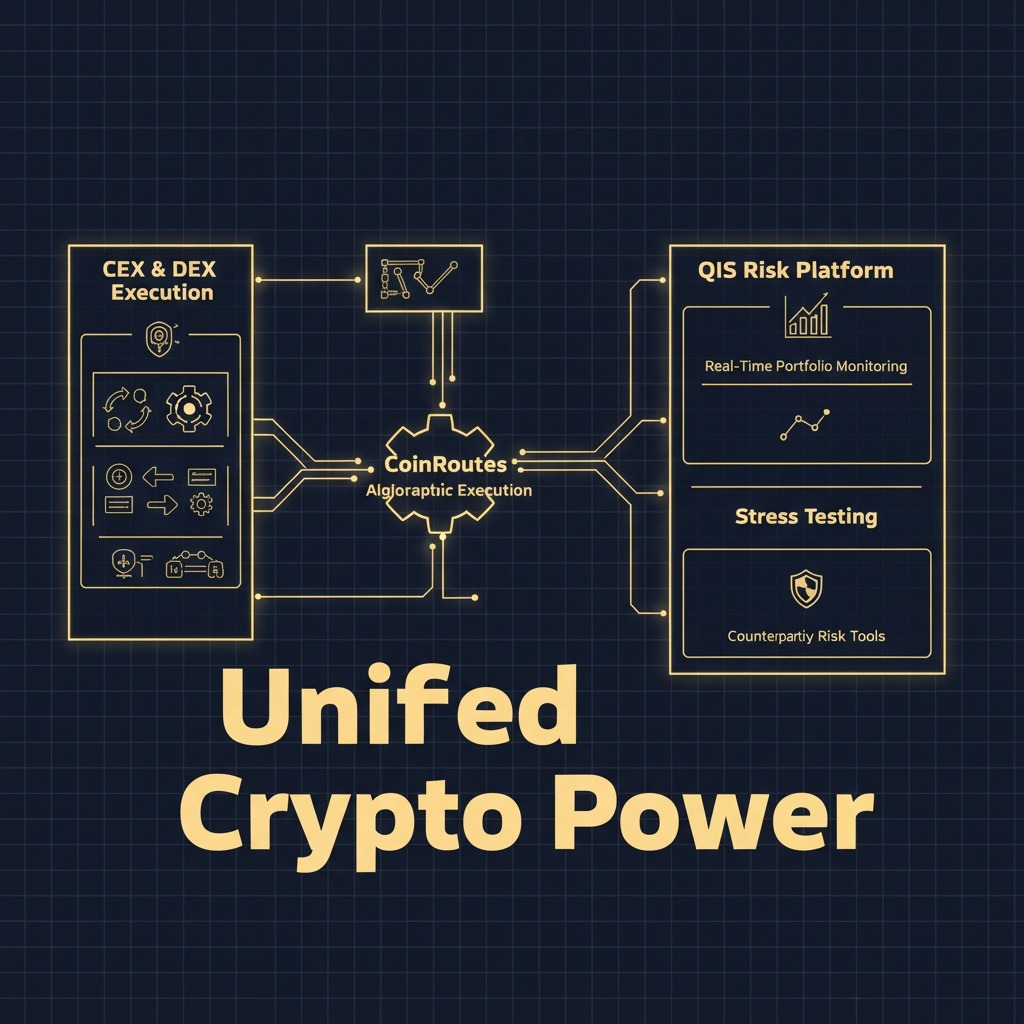

In a strategic move to enhance its institutional crypto trading capabilities, CoinRoutes, a leading platform tailored for institutional cryptocurrency trading, has announced the acquisition of QIS Risk, a prominent provider of portfolio and risk management solutions for digital asset managers. This transaction, valued at $5 million in cash and stock, was revealed in a press release issued by CoinRoutes on Tuesday. The acquisition signifies the unification of CoinRoutes’ cutting-edge algorithmic execution technology with QIS Risk’s powerful tools for portfolio monitoring and risk analytics. CoinRoutes boasts connectivity to over 50 exchanges and access to more than 3,000 digital assets, while QIS