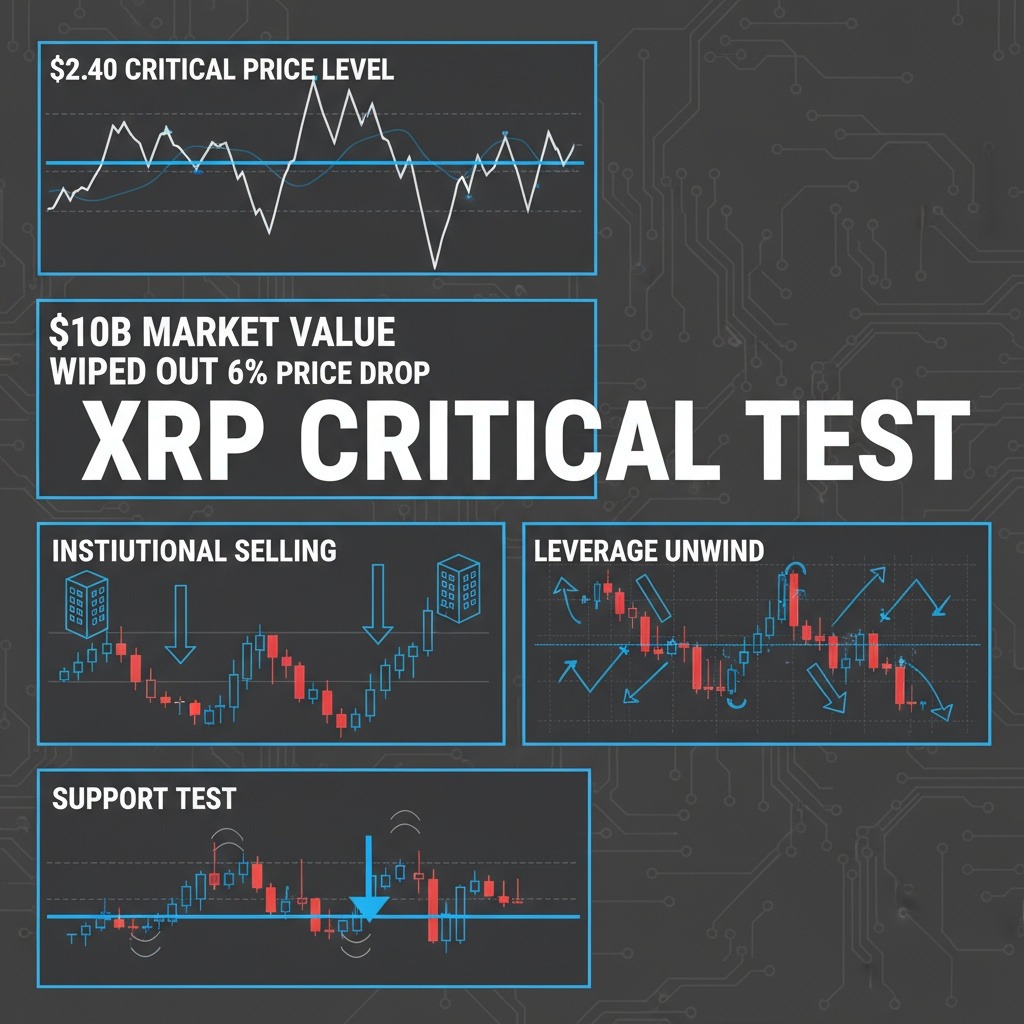

XRP Faces Crucial Test Near $2.40 as Institutional Selling Triggers Market Volatility

XRP experienced a significant sell-off this week, driven primarily by large-scale institutional liquidation across derivatives markets, which erased roughly $10 billion in market value. Between October 14 and 15, the price of XRP dropped sharply from $2.49 to $2.41, marking one of this month’s most pronounced single-day declines for the digital asset. The recent price drop follows a period of sustained selling pressure by major holders, often referred to as whales. Since October 10, approximately 2.23 billion XRP tokens, valued at around $5.5 billion, were transferred onto exchanges. This surge in supply contributed to heavy downside pressure. The futures market