Bitcoin (BTC) is steadily approaching a significant resistance level at $120,000, aiming for new all-time highs. As of this report, Bitcoin is trading at approximately $111,480, and traders are closely monitoring the situation as bearish sentiments attempt to defend the critical price point.

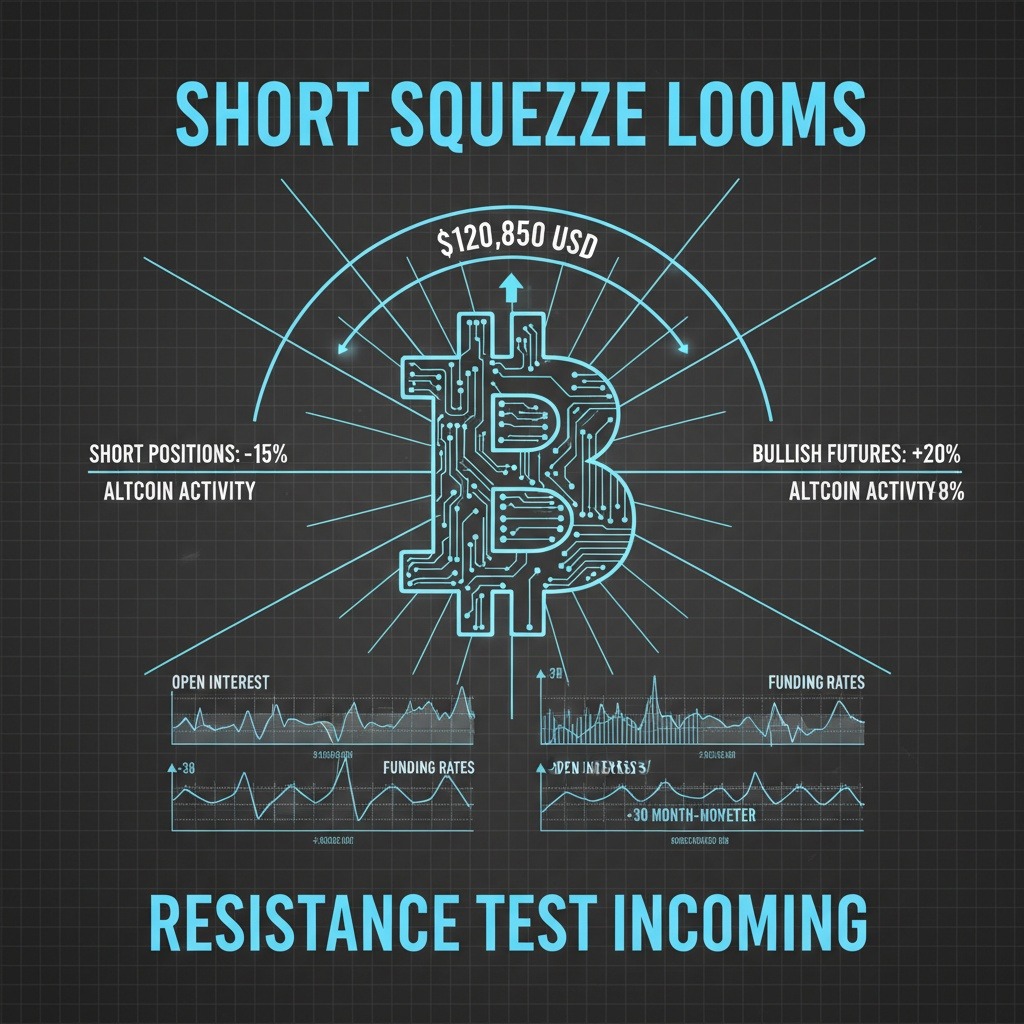

Recent activity in the futures market indicates a considerable increase in short positions, a move that might trigger a short squeeze if Bitcoin maintains its upward momentum. Historically, short squeezes can lead to rapid price surges, and some traders are positioning themselves to capitalize on this potential outcome.

In addition to Bitcoin’s performance, the altcoin market is also demonstrating positive movement. Coins such as Ethereum (ETH), Solana (SOL), and XRP have seen gains exceeding 2%. Furthermore, smaller market cap cryptocurrencies like ETHFI and CAKE have experienced notable increases, with rises of 15% and 25%, respectively.

However, this upward trend lacks the volatility seen in previous Bitcoin rallies. Instead of sharp price spikes, Bitcoin is showing a more gradual increase, which generally benefits altcoins by allowing more capital to flow into these smaller tokens.

On the derivatives front, the Bitcoin futures market remains robust, with open interest surpassing $32 billion, reflecting strong bullish sentiment. The annualized basis for three months is hovering around 8%, indicating continued confidence among traders. Still, a noteworthy divergence exists in funding rates across exchanges; Deribit is reporting a high funding rate of 25%, while Bybit shows a more neutral position, suggesting concentrated long positions at particular price thresholds.

While the options market appears relatively neutral, there has been a slight decline in bullish sentiment. The 24-hour put-call volume shows a slight preference for calls at 52.25%, although this is down from previous days. Additionally, the one-week 25 delta skew is close to flat at 0.33%, revealing a balanced outlook for implied volatility between puts and calls.

Data from Coinglass indicates liquidations totaling approximately $380 million over a 24-hour period, with a 35-65 split between long and short positions. Traders are advised to watch the $121,300 price level, which is identified as a critical point for potential liquidations, especially if Bitcoin’s price ascends.

Despite the overall positive trends in the market, not every token is benefiting from the upward movement. The MYX token has taken a significant hit, dropping by 43% due to a rapid deleveraging process. Similarly, the XPL token from Plasma continues to struggle amid rumors of market makers potentially shorting it on behalf of its founding team—claims that the XPL creators have publicly denied.

As the crypto landscape evolves, investors are encouraged to stay informed about market changes and monitor key price levels that could trigger significant movements in both Bitcoin and altcoins. The next few days could be critical as traders navigate through this interesting phase of market dynamics.