U.S. Treasury Posts Historic September Surplus Amid Persistent Bitcoin Stagnation

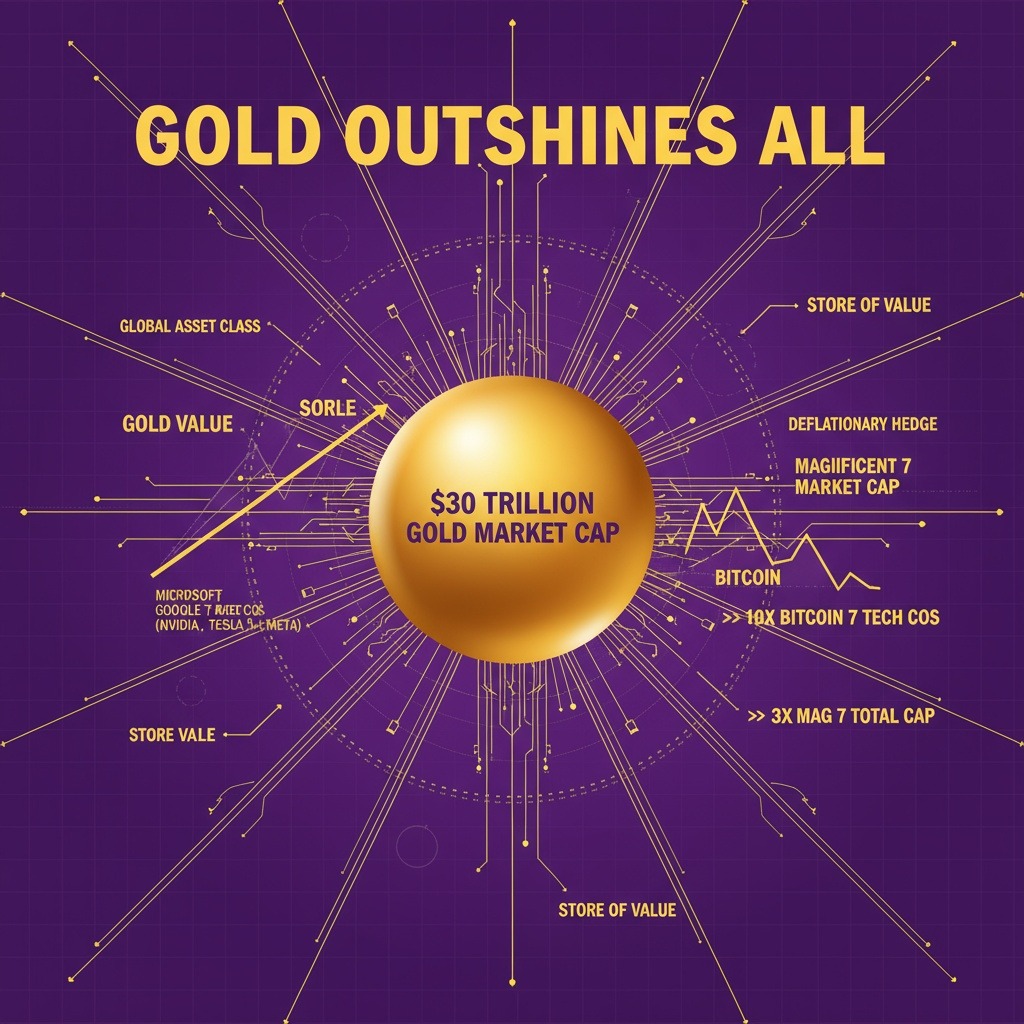

Bitcoin (BTC) continues to face challenges, holding steady around the $105,000 mark, while fiscal developments in the United States show a notably stronger trajectory. The U.S. Treasury recorded a substantial surplus of $198 billion in September 2025, marking the highest monthly surplus ever recorded for that period, according to data reported by CNBC. This fiscal achievement played a key role in reducing the overall budget deficit for fiscal year 2025 to $1.78 trillion, a decrease of approximately $41 billion or 2.2% compared to 2024 figures. September is traditionally a month with a fiscal surplus, primarily due to elevated tax collections.