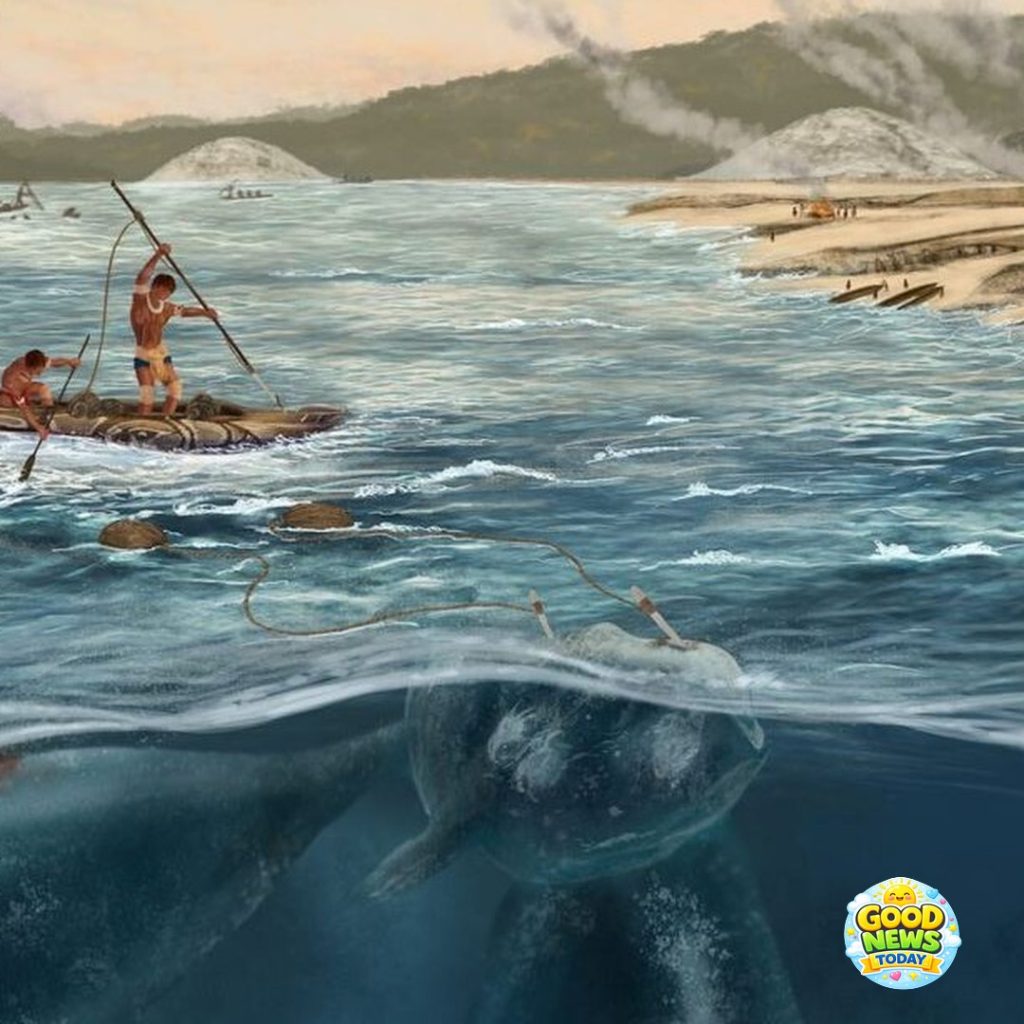

Cat meowing underwater.

In this delightful moment, we are completely enchanted by the charming and unexpected sound of a cat meowing underwater. The unique combination of the feline’s adorable vocalizations and the gentle ripples of water creates a whimsical atmosphere that highlights the playful nature of our furry friends. Each meow resonates with an endearing sweetness, showcasing just how captivating and entertaining our pets can be, even in the most unusual circumstances.