Aave, the leading lending protocol in the decentralized finance (DeFi) ecosystem, is on the cusp of a significant transformation with the anticipated launch of its V4 upgrade. This innovative version aims to reshape liquidity flow within DeFi by introducing a shared liquidity infrastructure that various lending markets can effectively leverage.

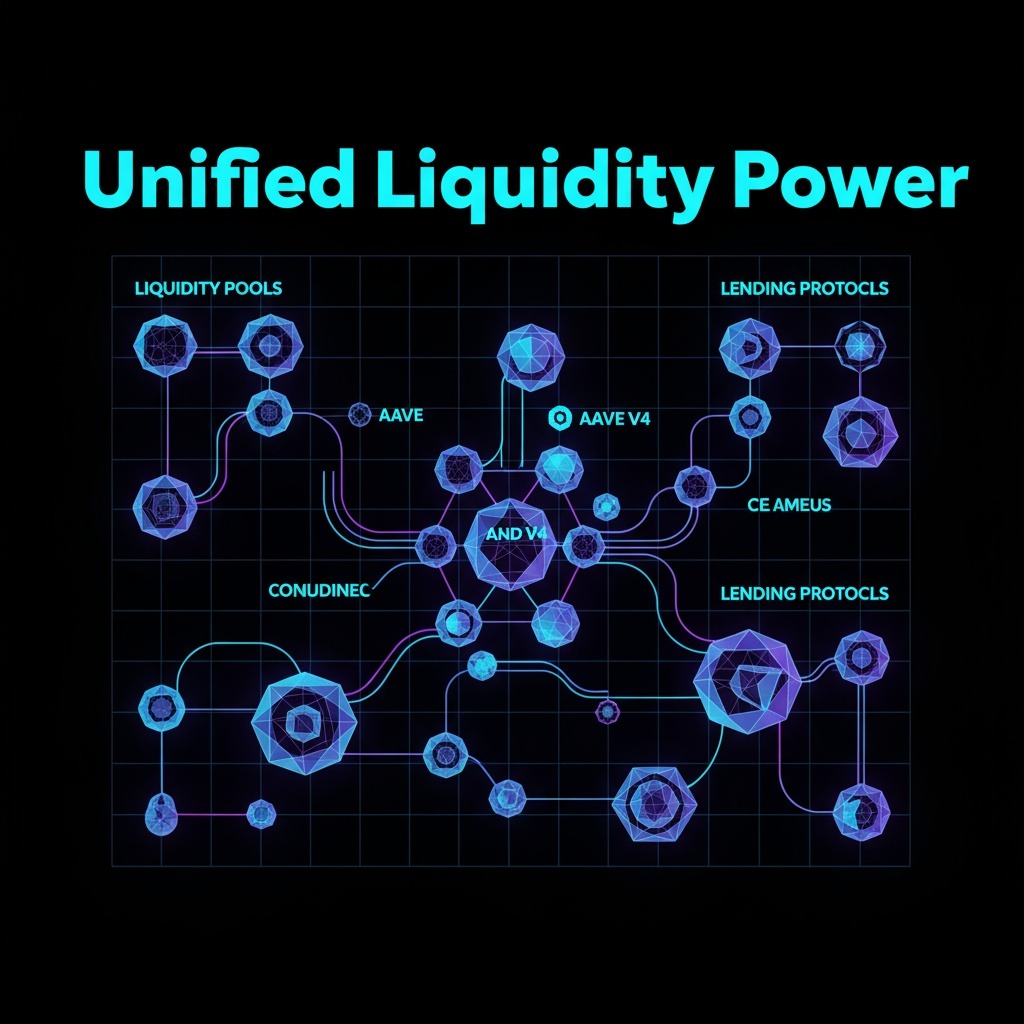

The latest insights from Aave’s development team outline a modular architecture that they describe as a “hub-and-spoke” model. With this design, liquidity is centralized within “Hubs,” while “Spokes” represent the various specialized lending markets that connect to these hubs. This architecture enables each Spoke to establish personalized lending rules and risk profiles, thereby enhancing the borrowing and lending experiences for users.

According to Aave’s development team, this new structure stands to significantly benefit the DeFi landscape. “Such an approach allows the broader DeFi community to build on top of Aave rather than seeing it as competition,” they noted. This strategy encourages service providers and integrators to design unique offerings while tapping into the expansive liquidity available, which could stimulate further innovation within the Aave ecosystem rather than splintering it among disparate markets.

Aave currently boasts over $45 billion in total value locked (TVL) across 19 different blockchains, according to data from DefiLlama. With the V4 rollout expected in the fourth quarter of 2023, Aave aims to establish itself as an essential infrastructure layer for DeFi, addressing the challenges faced by new markets that typically have to vie for deposits against already successful platforms.

The unified liquidity model of Aave V4 addresses a recurring issue seen in previous protocol versions, where liquidity was divided into numerous small and isolated pools. Under the new system, multiple markets can access a larger shared liquidity pool right from the outset, streamlining liquidity accessibility. For instance, a lending market focusing on PENDLE can easily borrow USDC from the shared pool, while another market dealing with Uniswap’s UNI can access ETH, and a stablecoin offering like Ethena’s sUSDe can draw from the same pool—effectively eliminating the need for separate liquidity pools for each asset pair.

Although several other DeFi protocols are also moving toward modular frameworks, Aave V4’s implementation is distinct. For example, Euler V2, which ranks as the tenth largest decentralized lending protocol, provides developers with the tools to create vaults that hold their own funds. However, these vaults do not have the same level of integrated access to a shared liquidity pool as Aave V4’s Spokes do. Similarly, Compound’s Comet promotes single-asset markets, yet it lacks the capacity for multiple markets to simultaneously utilize a collective liquidity source.

Aave’s development team refers to their V4 model as “DeFi’s operating system,” highlighting its potential to serve as a foundational layer that new markets can connect to without requiring the construction of independent liquidity systems.

Currently, Aave’s native token, AAVE, is trading at approximately $274. This figure represents a 94% increase over the past year, although it remains over 58% below its all-time high of $661 reached in 2021.